One of the biggest changes in sentiment among insurance company CIOs over the last two years has been the steady growth in interest in illiquid assets. These have moved centre stage this year, dramatically so for those attending the third Insurance Investment Exchange seminar of 2018 , held last week in the reassuring splendour of Skinners’ Hall.

A popular feature of all Insurance Investment Exchange seminars is the opportunity to capture the views participants through interactive voting and it was the results of these that revealed this sharp change in sentiment.

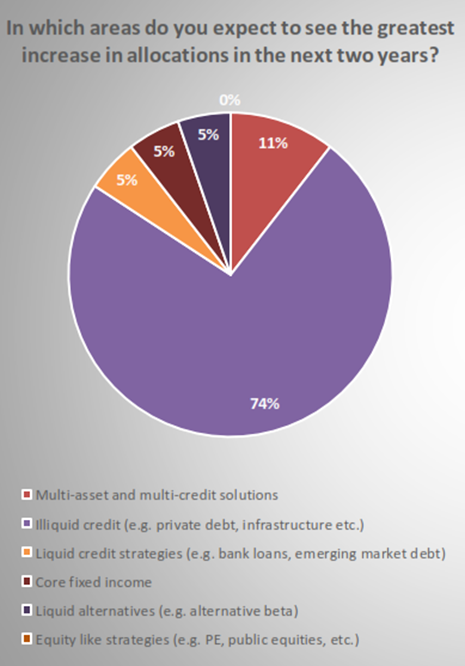

Waiting for Godot: Enhancing returns on capital was the theme and the answers to where insurers expected to see the greatest increase in allocation in the next two years left little doubt about where CIOs expect to find those enhanced returns.

An overwhelming 74% said illiquid credit, including private debt and infrastructure, would be the asset class in their portfolios most likely to see an increase. This trend started to build strongly at the end of last year when illiquids registered around 20% in answer to this question. It then moved up to the choice of around half of the respondents at the two seminars earlier this year. Now, it dominates.

This interest has been at the expense of all other asset classes, in particular, multi-asset and multi-credit solutions. These were favoured by just 11%, compared to 36% in March.

What lies behind this significant switch in sentiment?

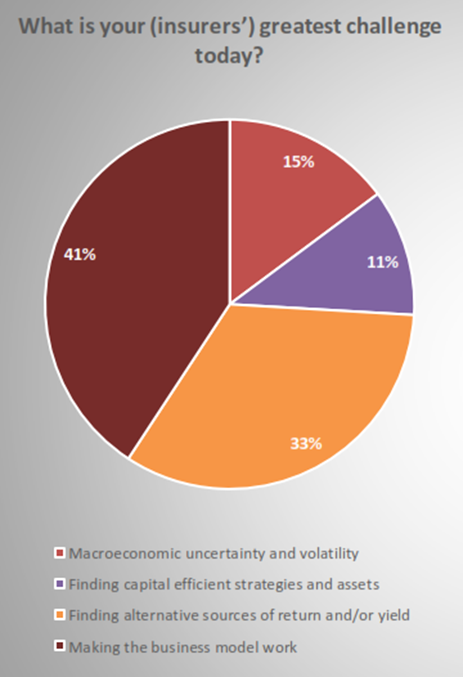

Perhaps the answer partially lies in the views CIOs have on the greatest challenges they face and their perception of where we are in the investment cycle.

Asked to name their greatest challenge today, there was a marked change with just 11% focusing on capital efficient strategies, compared to a third earlier this year. This was mirrored in the increase in those looking for alternative sources of return and/or yield, up to 33% from 17%. Meanwhile, the proportion worrying about how to make the business model work has remained at a consistent 30% to 40% over the last couple of years.

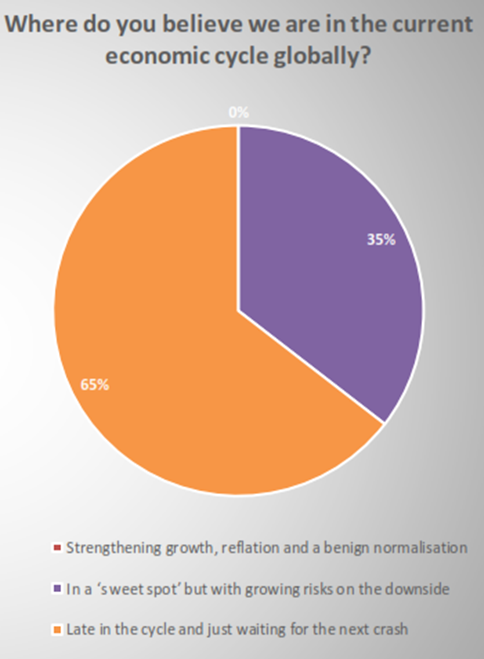

This switch is clearly influenced by several factors, but prime among those is their view of where we are in the current economic cycle globally.

This has seen the biggest changes in CIO views this year. Back in March an optimistic two-thirds believed we were in a “sweet spot but with growing risks on the downside”. That proportion dropped to under 30% in June: now such optimism seems to have vanished completely.

In its place, those who believe we are “late in the cycle and just waiting for the next crash” now account for two-thirds of those attending the seminar, up from 50% in June and just 25% in March.

This will not be the only factor influencing the switch from a focus on capital efficiency to finding alternative sources of yield, but it clearly represents a significant change in mood.

Insurer CIOs are cautious creatures, however, so do not expect to see wholesale switches in asset allocation.

Asked what percentage of their core fixed income assets they expected to reallocate to other strategies within the next two years, the caution that was consistent throughout 2017 and into early 2018 has returned, with 63% expecting to reallocate between 0% and 10% of their portfolios to alternative strategies. The June seminar had suggested hints that a more adventurous approach might be emerging but perhaps the gloomy view of where we are in the cycle has put an end to those fleeting adventurous thoughts.

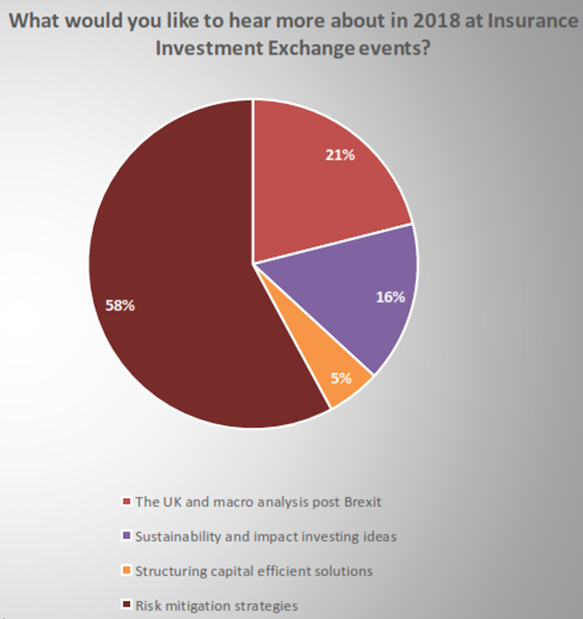

Fear, caution, gloom – whatever you call it – showed through in the answers when asked what attendees wanted to hear more about at future insurance Investment Exchange events. Risk mitigation strategies was the top topic for 58% of the attendees.

The next seminar – Ghosts of Christmas Past, Present and Future – looks into what 2019 might hold and takes place on Wednesday 27 November at Skinners’ Hall. Further details of the topics and speakers will be available soon. You can register your interest now by emailing .