David Worsfold

Insurance investment professionals were in a distinctly downbeat mood when they gathered in the grandeur of Skinners’ Hall for the final Insurance Investment Exchange seminar of 2018 at the end of November.

Although it was almost time to unwrap the Christmas decorations, there was very little Christmas cheer as they contemplated the seminar theme of ‘Ghosts of Christmas past, present and future’. A popular feature of all Insurance Investment Exchange seminars is the opportunity to capture the views of the participants through interactive voting and if there was a button marked “Gloomy”, then it seems fingers were going straight for that.

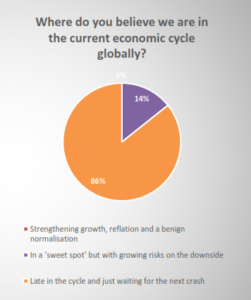

The sense of growing pessimism was revealed immediately in the opinions expressed when asked “Where do you believe we are in the current economic cycle globally?”.

The responses to this question have been sliding towards negativity all year. At the start of the year, just a quarter felt we were late in the cycle and waiting for the next crash. By the end of the summer, a strong negative sentiment was building with 65% feeling that was where we were. As the year draws to a close, an overwhelming 86% have nailed their gloomy colours firmly to the mast of pessimism.

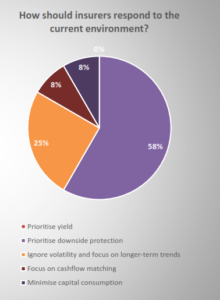

How does this view of the immediate future shape their responses as managers of massive investment portfolios? Again, the mood has altered dramatically through the year. Back in March CIOs looked set to hold their collective nerve. 43% said they would ignore volatility and focus on longer-term trends while just 21% were more pessimistic, saying they would prioritise downside protection. Now, 58% are now in the pessimists’ camp.

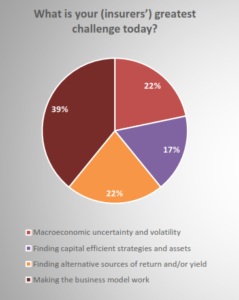

A much more consistent theme over the last two years has been the feeling that CIOs are being asked to achieve the impossible. This was again reflected in the answers to the question “What is your greatest challenge today?” with 39% pointing firmly at the business model.

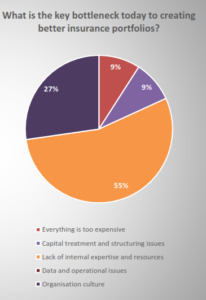

This concern also extends to a lack of confidence that senior management is willing to address the issues. There have been consistent grumbles about a range of internal factors presenting the biggest bottlenecks to creating better insurance portfolios.

These are reaching a crescendo with 55% pointing to a lack of internal expertise and 27% fingering the organisational culture as the culprit.

Looking ahead – trying to identify those ghosts of Christmases to come – CIOs hardly know where to look.

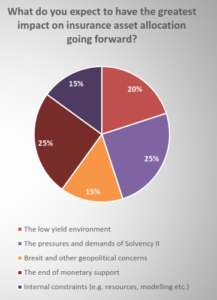

Responding to the question “What do you expect to have the greatest impact on insurance asset allocation going forward?” every option found its adherents with the end of monetary support and Solvency II concerns bothering marginally more than the other options. Brexit features at the top of the agenda for some.

When asked about topics for Insurance Investment Exchange seminars in 2019, the rapidly emerging issues around sustainability features strongly as does the continuing need to find new ways of structuring capital efficient solutions. Others are still looking for help to develop appropriate risk mitigation strategies.