The final Insurance Investment Exchange seminar of 2019 looked back over 2019 and peered into the crystal ball to see what 2020 may hold for the insurance industry.

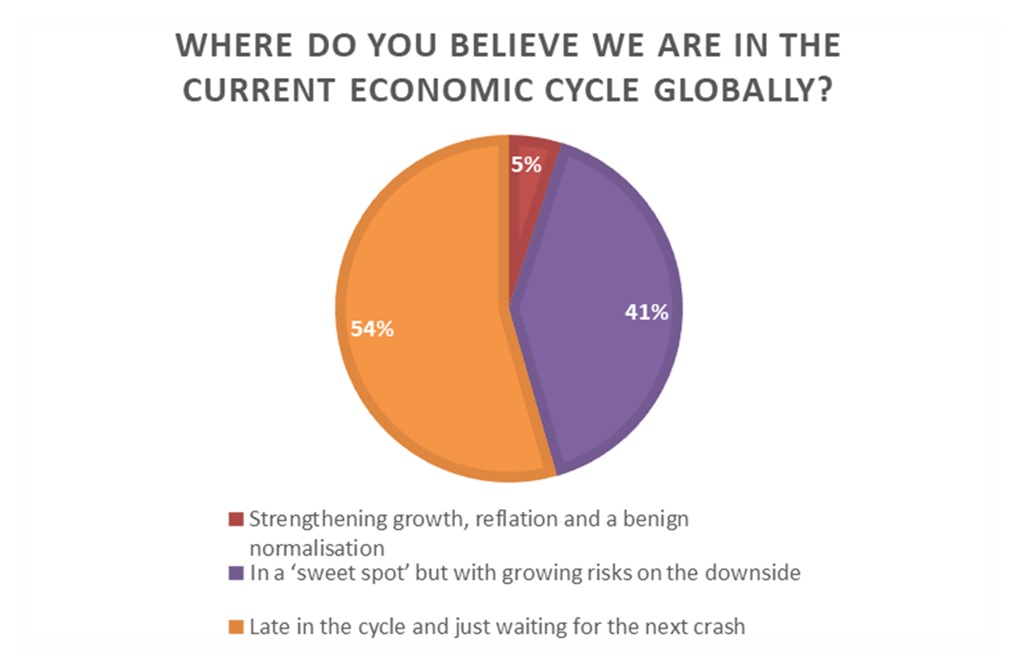

The scene was set by Charles Dumas from TS Lombard who said he believed markets are in the midst of a positive patch. The insurers in the audience were more downbeat, however, as they considered the possibility of lower yields for much longer, and the impact that could have on both portfolio strategy and the business model. This was reflected in the audience voting, a feature of Insurance Investment Exchange seminars. This revealed an optimistic 41% felt the current economic cycle was in a “Sweet spot but with growing risks on the downside”. Although this suggested a more upbeat assessment of current conditions than at earlier seminars in 2019 there was still a solid 54% in the audience who believed we are “Late in the cycle and just waiting for the next crash”.

Dumas admitted there were a few very dark clouds looming on the horizon, especially the US Presidential election in 2020, but he made a compelling case for believing stronger Dollar rates could be a feature for the next few years. US core inflation has remained stubbornly below target just as the world seems to be moving towards a much more Keynesian menu of economic policies, bringing the need to finance larger deficits.

Alongside this, broader trends are also having an impact with a shift away from globalisation to regional economic blocs leading to higher costs and lower productivity of capital. Demographic trends are playing a part too. The falling share of working-age people in developed markets and in China is raising relative demand and strengthening the bargaining power of labour. He also showed how, despite the US-Sino rhetoric, the decline in world trade has bottomed out with the end of the summer brining the first uplift for over two years.

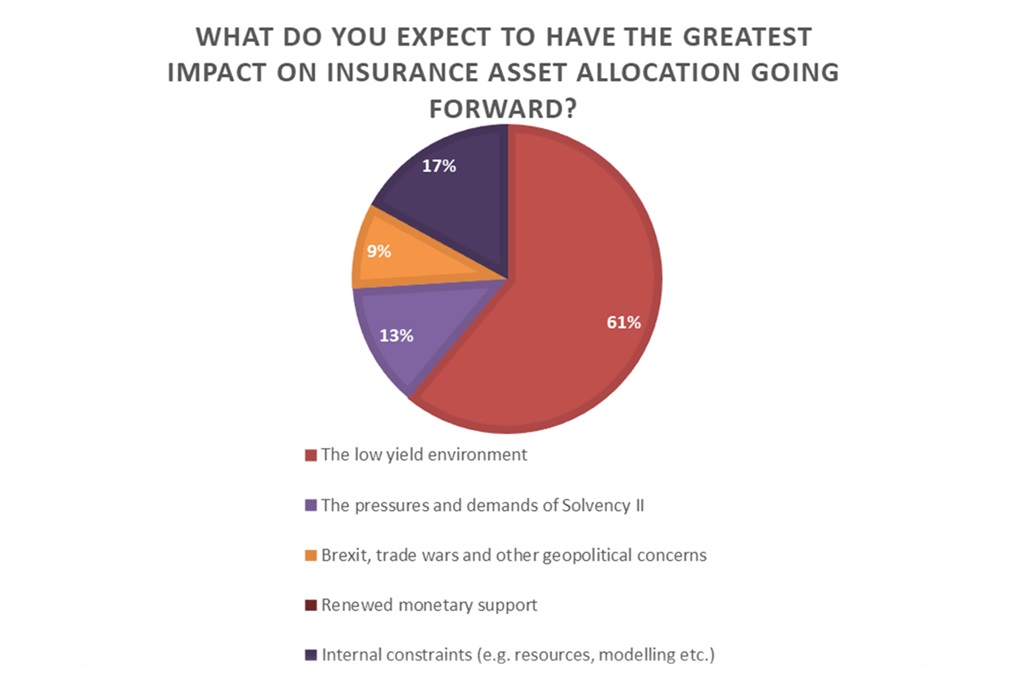

If the US can lead an uplift in rates this should bring some relief to CIOs who still believe the biggest impact on asset allocation is going to come from the continuing low yield environment. 61% put this at the top of their concerns, dwarfing those feeling the pressure from Solvency II or worried about the impact of Brexit and trade wars.

Other speakers on the panels sought fresh answers, finding pockets of opportunity and ways of extracting more from the core portfolio. Portfolio construction and dynamism through multi-asset credit allocations were two ideas.

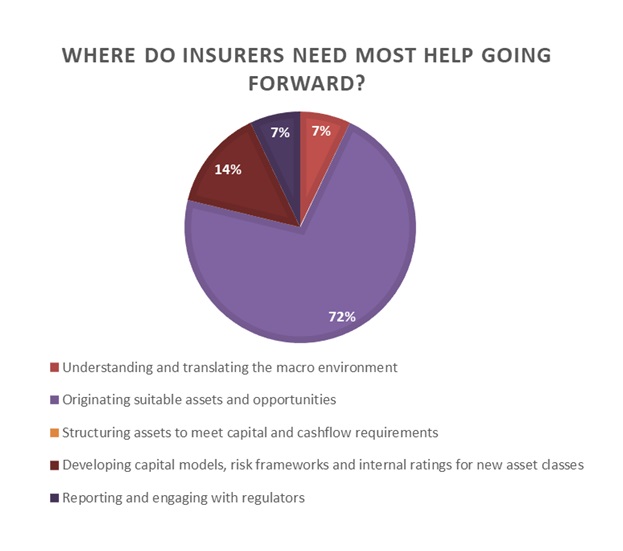

They also explored a range of opportunities from direct consumer finance and mortgages, to a wider range of new structured and traditional financing strategies now making their way into the CIO’s consideration. Origination, however, remains the primary challenge and it is clear a long-term sustained effort will be needed to develop the capabilities and resources to fully realise some of these new avenues in the private markets especially. Of all the questions asked during the interactive voting it was the answers to “Where do Insurers need most help going forward?” that produced the most decisive repose. 72% said “originating suitable assets and opportunities” was the number one challenge.

The breakout sessions during the seminar looked in-depth at a range of related topics

- Hunting for opportunities in global credit: multi-credit strategies for insurers was the theme of the Allianz Global Investors session.

- Aviva Investors tackled Portfolio construction: Tapping a misunderstood alpha source.

- Structured credit: Back to the future? Opportunities for insurers was the topic for the Axa Investment Managers team.

- M&G Investments looked at Direct consumer credit: A new investment avenue for insurers?

Full details of the 2020 seminar programme and other Insurance Investment Exchange events will be available soon on the website https://insuranceinvestmentexchange.com