Insurers will be focussing hard on protecting investment portfolios against the potential downsides as the Covid-19 crisis continues to reverberate around the world.

This was one of the key conclusions from the Insurance Investment Exchange’s two-part seminar surveying the insurance landscape as we creep back towards a new normality. It was held over two 90 minute sessions on consecutive days and followed the familiar pattern of presentations, panel discussions and audience voting.

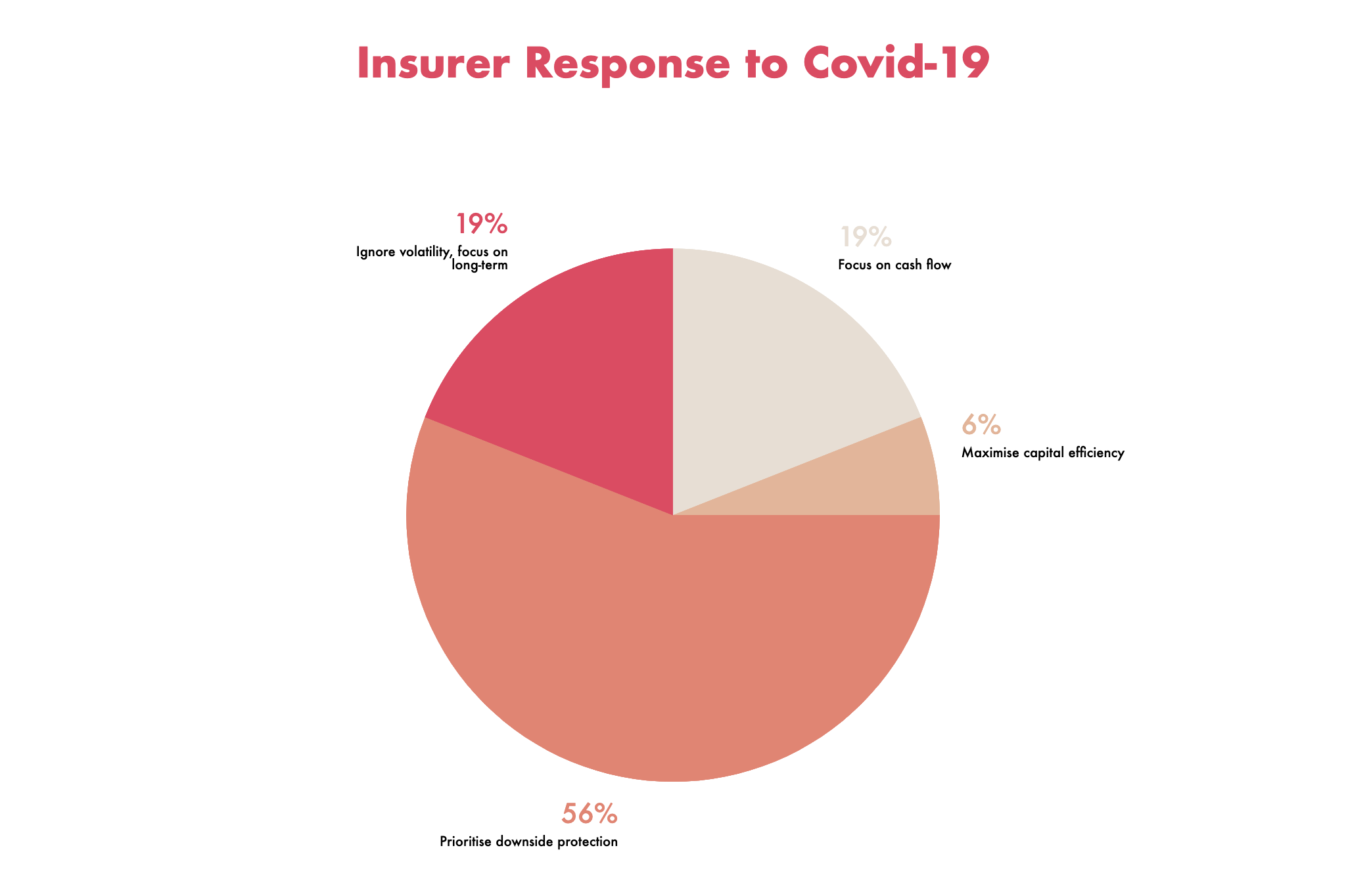

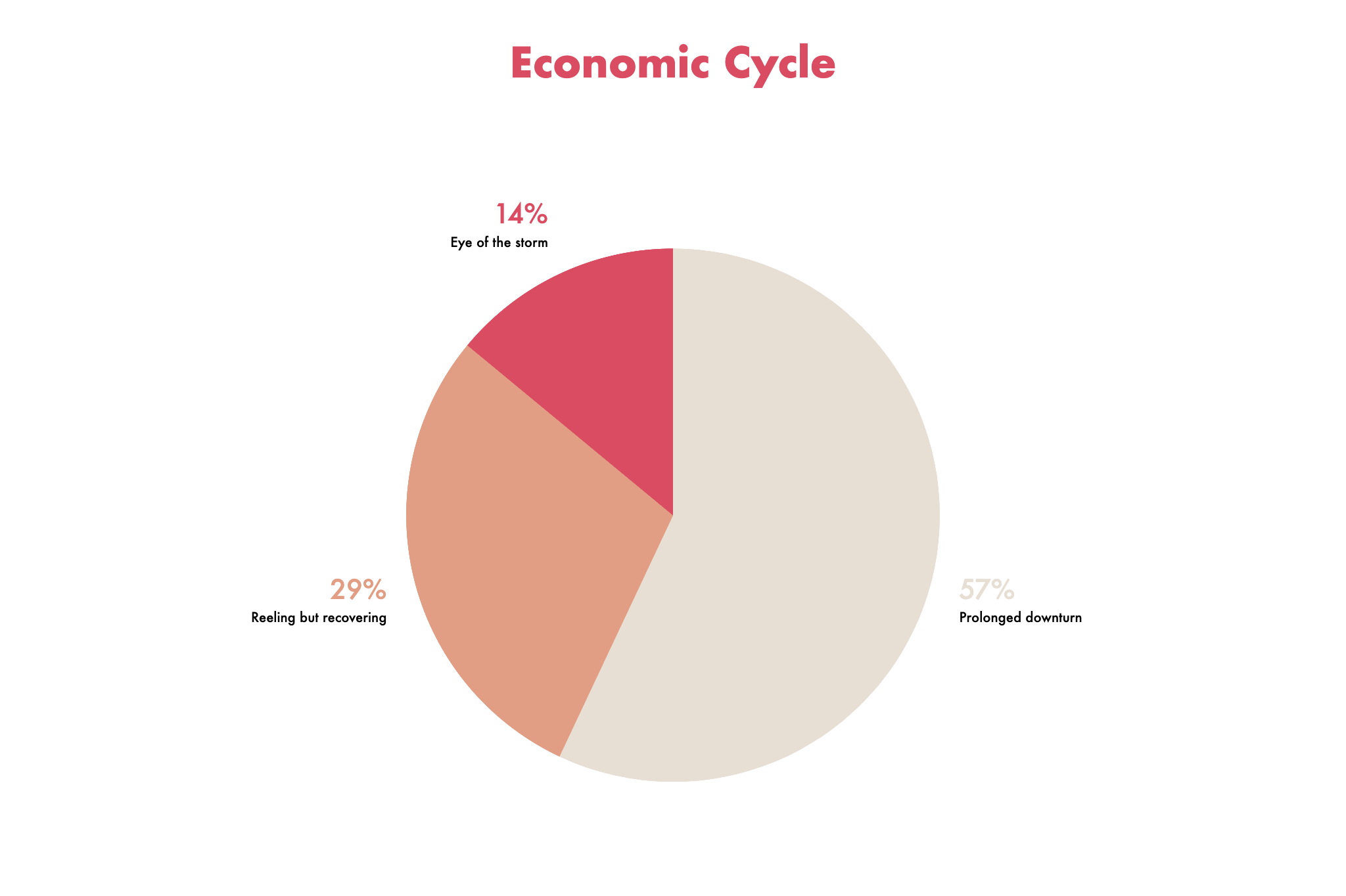

With the majority of the audience anticipating a prolonged downturn when asked “Where do you believe we are in the current economic cycle globally?” (see Economic Cycle graph) perhaps it was not surprising that they also put protecting against the downside as their top priority when asked “How should insurers respond to the current environment?” (see Insurer Response).

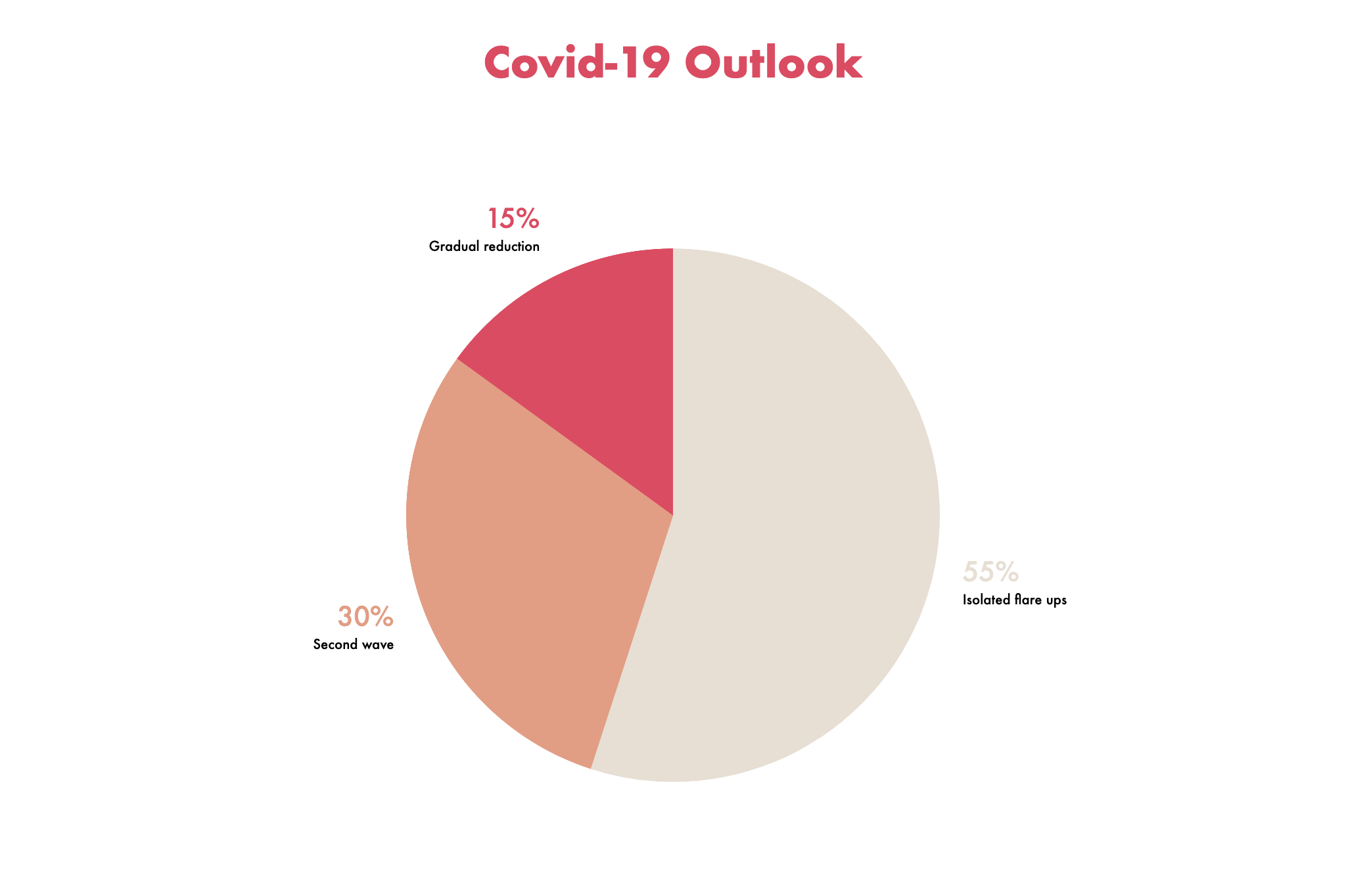

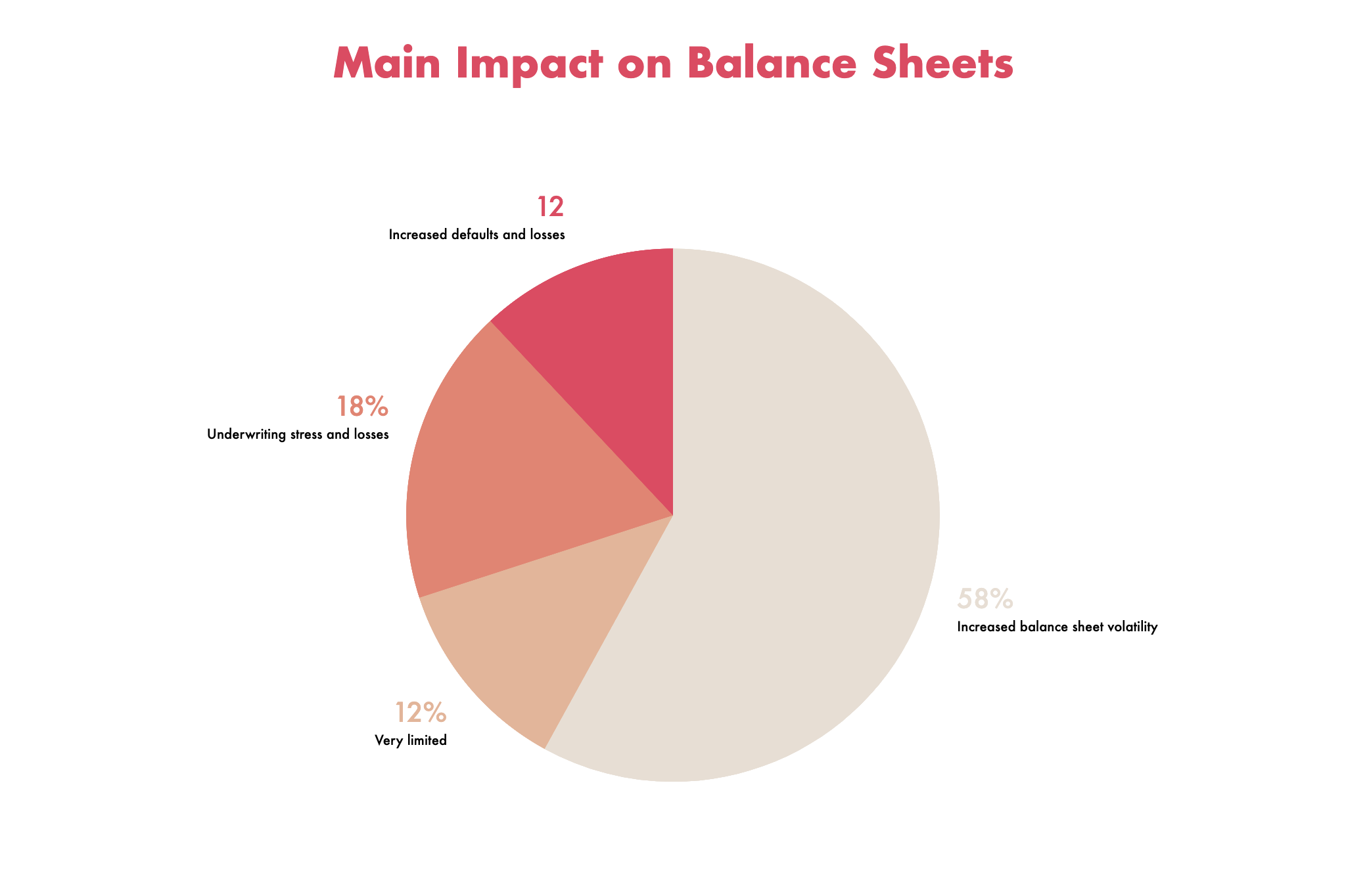

Other questions asked how they expect the pandemic to progress now the initial wave – at least in the UK, Europe and the Far East – has subsided and what impact it has had on their balance sheets, which showed that volatility is the number one concern.

The first session analysed structured credit and its current place in insurance portfolios. With the help of James King, Director, Fixed Income, M&G Investments, the current market conditions were placed in the context of longer term trends, particularly those following the global financial crisis of a decade ago.

This prompted a panel discussion that looked at the state of play for other parts of the fixed income universe and considered the outlook for private debt. The panellists and audience also debated the real economy’s financing needs and the role that insurers had to play.

Pricing of private assets was a key concern for everybody with the difficulties of benchmarking price and value against public assets disrupted by the extreme market volatility seen over the last few months. Some prices have in effect been frozen as transaction volumes are so low and so do not fully effect the impact of the Covid-19 crisis.

First session panellists

- Prasun Mathur – Private Assts Lead, Aviva UK

- Will Nicoll – CIO, Private & Alternative Assets, M&G Investments

- Erik Vynckier – Chair of Research and Thought Leadership, Institute and Faculty of Actuaries

The second session opened with a review of the Asian private credit market drawing out the lessons for financing the real economy, led by Sumit Bhandari, Lead Portfolio Manager for Asia Private Credit at Allianz Global Investors. This stimulated a wide-ranging discussion that looked at the impact of the huge central bank and government interventions with fears surfacing that this is making it harder to assess value and might be shielding zombie companies.

There are reasons for optimism as opportunities will develop from the upheaval caused by the pandemic. The continued withdrawal of the banks from trade finance and the government focus on infrastructure as a key economic policy response to the crisis were among those highlighted by panellists, with socially responsible investments expected to be a particular feature of infrastructure programmes.

Second session panellists

- David Thompson – CIO, Zurich Insurance

- James Kenney – Head of Capital Management, L&G Capital

- David Newman – MD, Fixed Income, Allianz Global Investor

••••••••••••••••

- The next seminar will be on 24 September. Entitled The New Normal? it will examine the evolution of the regulatory landscape as well as changes in asset allocation and portfolio construction as insurers adapt to a more challenging era of renewed fragility and much lower for (ever?) longer yields.