We live in an age of uncertainty but institutional investors, including insurers, do not always appreciate the wider potential impacts on investment values of the most serious threats.

That is the warning from leading risk consultant Jonathan Graham (pictured below).

“Don’t look at risks in isolation. It is important to look at the inter-connectivity of risks in the underlying assets in your portfolio. Transparency is the key to fully understanding exposures”, says Graham, who is Principal of Vitruvian Risk and Resilience Consultancy.

This need to look beyond the obvious uncertainties and see how a broader mix of risks might impact an insurer’s assets is crucial but it might not always be obvious where those risks reside and how they might interact.

“As a CIO you have your portfolio and you look at risks such as currency and duration all the time but do you have a focus on geography as well? This means facing up to political risks which can have a big and abrupt impact on asset valuations”, say Graham.

Geo-political risks are the hardest to predict and the most sensitive and are often overlooked for that reason: “People just park it in the ‘too difficult’ category and don’t address it”.

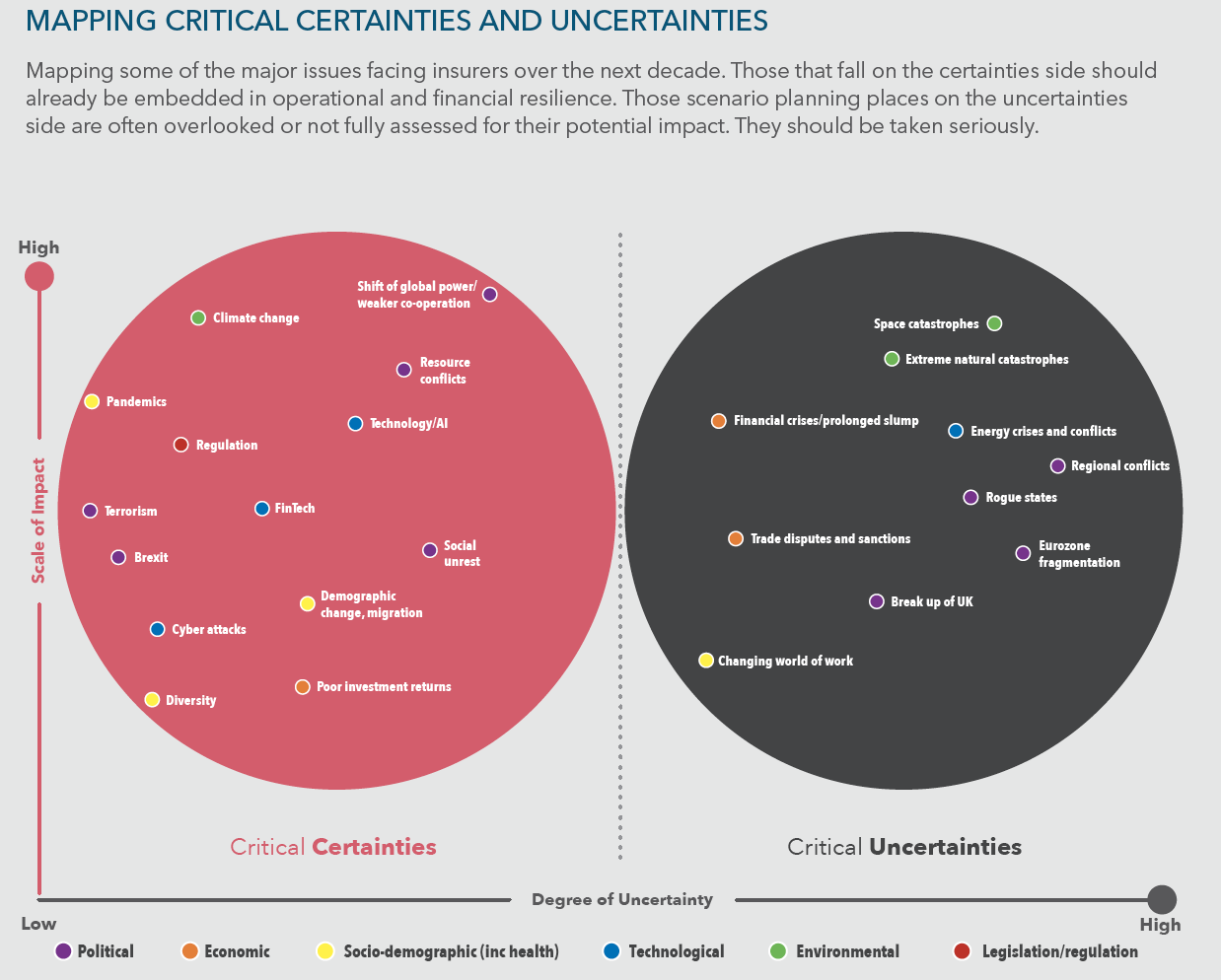

Many of these were highlighted in a research project Graham ran with leading corporate law firm DAC Beachcroft last autumn – Resilience in the face of uncertainties: More than just keeping the lights on. This divided the disruptive forces surrounding insurers into “critical certainties” and “critical uncertainties”, the latter being those frequency consigned to the ‘too difficult’ tray (see chart). These include the potential for conflicts to flare up, perhaps in the South China Sea where China’s expansionist ambitions are already causing friction. This could very quickly cause severe disruption to global trade with sanctions and potential naval blockades of Chinese ports. CIOs need to understand where those risks might be hidden in their portfolios, argues Graham.

“I am not entirely sure that all CIOs have full transparency on what the ultimate underlying assets in their portfolios are. You only have to look at the global financial crisis to understand that with the way CDOs [collateralised debt obligations] were packaged up and put onto balance sheets”.

“I am not entirely sure that all CIOs have full transparency on what the ultimate underlying assets in their portfolios are. You only have to look at the global financial crisis to understand that with the way CDOs [collateralised debt obligations] were packaged up and put onto balance sheets”.

While scrutinising portfolios for those often overlooked critical uncertainties, Graham says a clear focus must be kept on the more obvious and immediate disruptive issues, such as climate change and cyber threats.

“After the pandemic, there is going to be a re-set and it will be a little like ‘Back to the Future’ with climate change and cyber. They have the potential in the longer-term to be even more damaging than the pandemic”.

They also illustrate the importance of looking for the connections and exposures across a portfolio.

“It is important not to be over-exposed to sectors of the economy that could be badly impacted by major cyber incidents. The impact of a large scale cyber event could be to reduce your balance sheet overnight with potential implications for solvency too.”

With climate change, Graham believes that insurers need to be very clear on their direction of travel when it comes to responding to demands from governments, regulators, inter-governmental organisations and determined campaigners but not rush into sudden, drastic changes of policy without first considering the wider implications.

“The green revolution is upon us, it is not one for the future but the transition has to be slow and steady. Some companies have been very bold and have said they are not going to underwrite or invest in fossil fuel companies any longer but the impact that might have on the wider economy needs to be considered too. If this goes too far, too fast it could lead to an energy crisis which could reduce the value of other assets.

“I think we need a pragmatic approach to this transition to green energy. That needs a constructive dialogue with those arguing for a faster transition to make it clear that the direction of travel is right but at a steady rate”, says Graham.

Download Resilience in the face of uncertainties: More than just keeping the lights on

Jonathan Graham was talking to David Worsfold