Insurance Investment Exchange this week launched its latest digital roundtable series – Off the Beaten Track – which aims to explore new emerging asset classes and themes appearing in insurance portfolios as insurers balance tackling low yields with mitigating tail risks.

The first event in this series looked at the potential appeal of music royalties to insurers with the help of Paul Dackombe and Philipp Saure of Tailwind Entertainment.

Music royalties are attracting growing interest given their attractive yields, predictable stable cashflows, low correlation to traditional assets, longer duration and ability to fit into capital efficient solutions. Participants heard how the growth in streaming platforms – driven faster by the pandemic – has led to an increase in revenue streams, while technology now has the potential to remove inefficiencies in revenue collection, further enhancing returns.

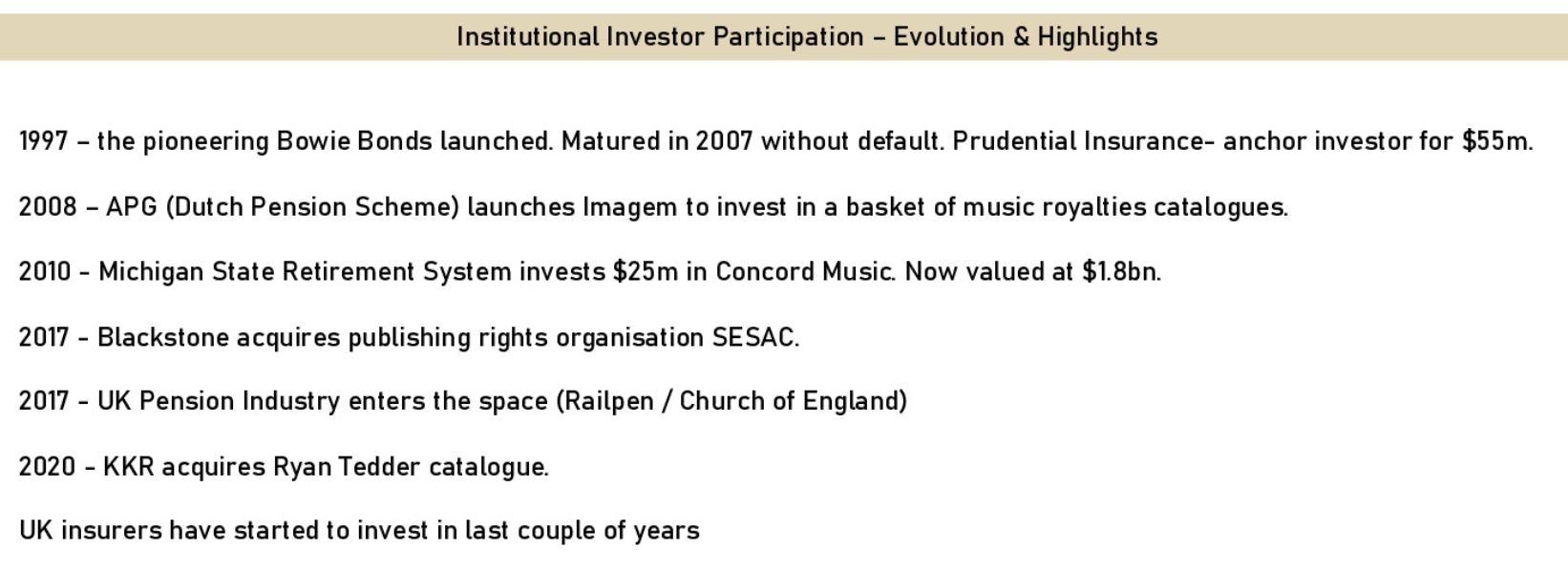

This is not a new asset class for insurers. Prudential Insurance was an anchor investor to the tune of US$55m for the pioneering 10 year ‘Bowie Bonds’ that were launched to realise the value in David Bowie’s catalogue in 1997 (see timeline). These matured in 2007 without default. Since then, other insurers have shown a modest interest but the market is now ripe for significant growth, said Dackombe, who heads up the business and commercial operations of Tailwind.

This is not a new asset class for insurers. Prudential Insurance was an anchor investor to the tune of US$55m for the pioneering 10 year ‘Bowie Bonds’ that were launched to realise the value in David Bowie’s catalogue in 1997 (see timeline). These matured in 2007 without default. Since then, other insurers have shown a modest interest but the market is now ripe for significant growth, said Dackombe, who heads up the business and commercial operations of Tailwind.

“Pre-Spotify and pre-digitalisation in terms of file-based services the music industry was in a bit of a death spiral. Napster had broken apart the revenue stream, physical sales were declining and people were file sharing. The music industry really didn’t know how to fix this problem until Spotify, Apple and iTunes came along and got them out of a hole”.

Since then the market has flourished, growing 7% compound annually over the last five to six years.

He explained how the underlying assets were split between master recordings, usually owned jointly by recording companies and artists, and publishing, the rights owned by the composers/writers. The latter were far more attractive to institutional investors, explained Dackombe as they produced “more predictable and more stable recurring revenues”.

Tailwind CIO Saure said there were many reasons why creators, who own the rights until 70 years after their death, might want to realise the value of those assets. It could be to finance new projects or support their lifestyle, something that the pandemic has accelerated for performing artists.

“Live music has historically been quite an important component of their income and that has completely fallen away. It was lost in 2020 and is not going to recover in 2021.”

There are also other potential significant boosts to this market, such as the release of so-called “black box royalties”. This is money from streaming services and others that has been collected by the 270 organisations responsible for collection around the world but has not yet been attributed to its rightful owners because they have not been identified. If not claimed within three years, this money is distributed to all owners according to previous market share, which lifts the income of the well-estblished biggest earners.

There are a lot of inefficiencies in this system which are ripe for being ironed out, said Saure.

“It is not that the information doesn’t exist. It just resides in different databases and it is perfectly possible to reconcile these. It would be going after money that is already there.”

This is estimated to be around 13% to 15% of all royalties collected.

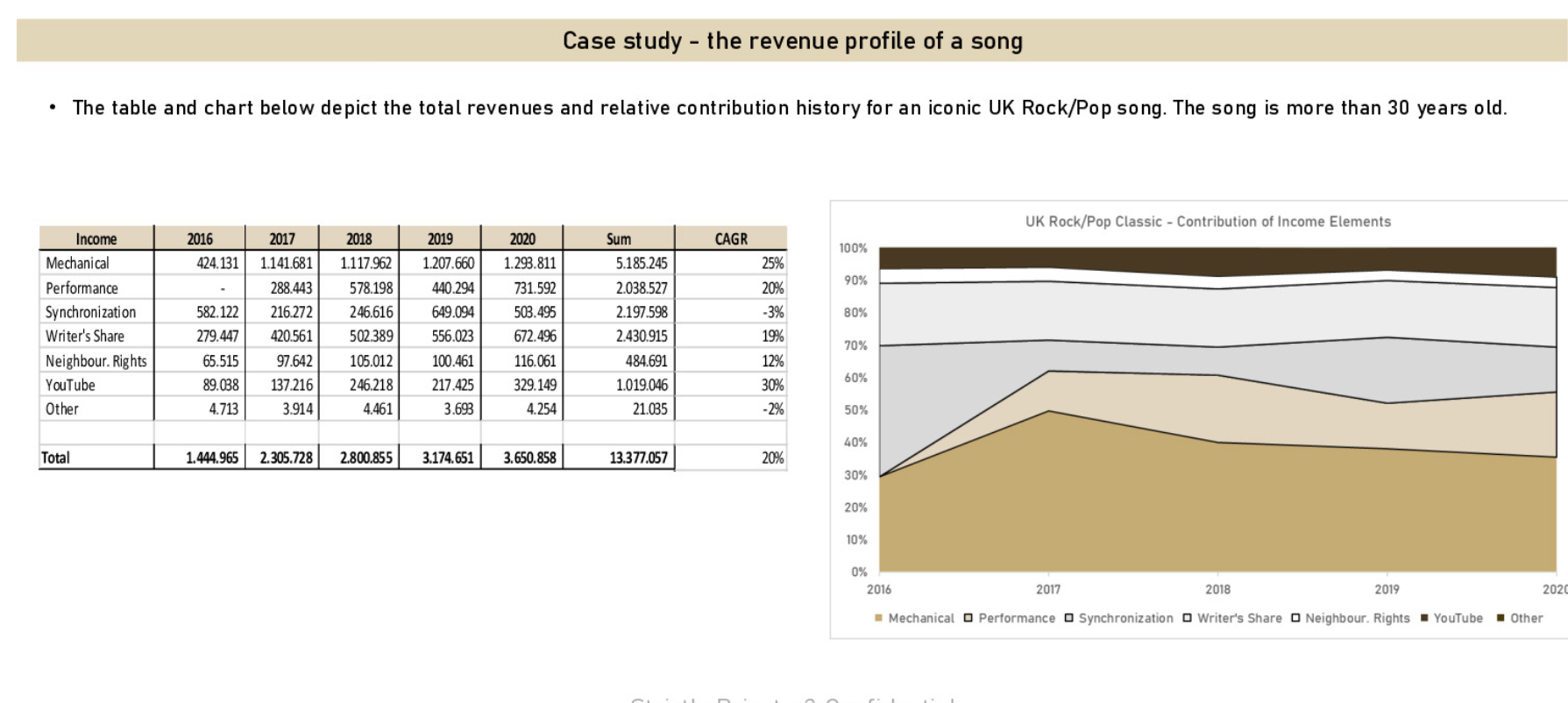

He illustrated the way the different revenue streams around a popular song can develop over time with an example of the last five years’ earnings for a 30 year old major UK hit (see slide at top).

Securitisation vehicles are likely to be the best way for insurers to take up this opportunity as it would give them a quasi-fixed income asset with higher yields to put into the portfolio. Tailwind is currently working with a large investment bank to create an unrated securitised structure that will have the potential to morph into a rated structure.

The discussion among the participants highlighted some of the potential drawbacks of having an unrated vehicle as it would be very hard to get regulators to sign off on internal ratings for an asset class they were not familiar with.

• Look out for details of the next roundtable in the Off the Beaten Track series

Reporting by David Worsfold, Contributing Editor