Inflation is gradually casting long, dark shadows across insurers' investment portfolios, exposing cash holdings to new risks and making balance sheet stability harder to achieve.

This was the key focus of day two to the Insurance Investment Exchange’s virtual summer seminar, entitled Quo Vadis: Inflation, Out of Cash and Becoming Climate Aware, writes Contributing Editor David Worsfold.

The keynote presentation from David Parsons, Director – Fixed Income, and Russell Lee, Global Head of Insurance Solutions, both from M&G Investments, set the context of the inflation challenge and the risk it could bring to insurer portfolios.

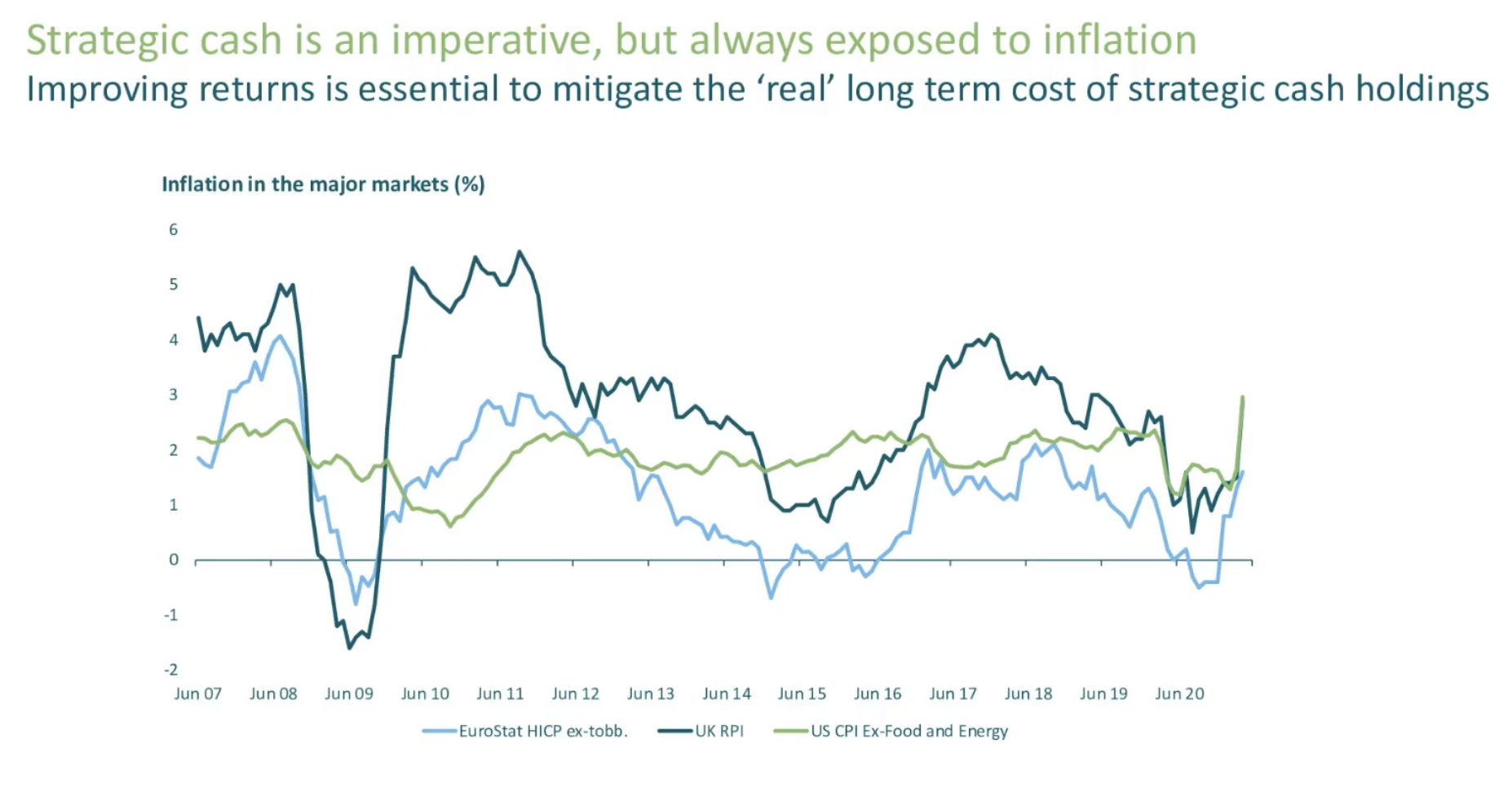

With €190bn held in cash by European insurers, the exposure to inflation risks is very significant, said the M&G team, meaning that holding cash could become increasingly expensive. People with significant cash assets need to start thinking about how they can get it to work a little bit harder for them, they said, and went on to outline a range of options for insurers.

By imposing a structure on cash holdings based on how they are needed to meet liabilities, it should be possible to re-direct some of the money to assets less exposed to inflation risks. They suggested a break down by Strategic, Tactical and Immediate cash holdings and that the re-allocation should focus on strategic cash where the biggest risk sat.

Short-dated government bonds provided one option but that is not with its downsides as not all bonds are created equal. Some are more volatile and the capital impact on a mark-to-market basis can be critical. Corporate credit could be another option but that, too, came with greater risk and volatility.

Their favoured option was European AAA asset-backed securities. They acknowledged that these have received a bad press in the past but pointed to the attractive yields and the particular appeal of Sterling denominated securities as these are currently cheaper than their European counterparts.

The panel session which followed focussed on asset allocation in the lower for longer world and explored various options for portfolio diversification using private assets.

Lee opened the panel by highlighting the need to isolate liquidity risks so insurers could look to switch into illiquid assets. The challenge in that space would be to find investment grade shorter-dated assets.

David Devlin, who is the Annuity Fund Investment Lead at Scottish Widows, said the switch to private assets is “more an evolution than a revolution”, especially once regulatory requirements and need to adjust models is taken into account. He said that an annuity fund was more focussed on spread than yield.

Increased allocations to private credit are likely to continue, said Gareth Sutcliffe, Senior Director, Insurance Investment Solutions at Willis Towers Watson: “Private assets are now just part of the toolkit”, he said, although he warned that some, such as commercial retail and student accommodation had been adversely impacted by the pandemic.

He highlighted how the growing awareness of climate change and the need to hit net zero targets meant that the “willingness to invest in climate solutions is growing”.

Climate change and ESG strategies are the subject of an IIE Business Practices Survey and IIE founder Dr Bob Swarup outlined the preliminary findings of the survey for the audience. Look out for further details on this later this month.

• Report of day one of the IIE’s summer seminar – Charting a course through the fog of uncertainty

• Many of these issues will be followed-up next week at the next IIE Digital Roundtable in the Rethinking the Insurance Opportunity Set series.

Cash Dethroned: Reallocation Opportunities for Insurers under Solvency II, in partnership with M&G Investments, will take place on Thursday 15 July at11am-12.15pm BST (12-13.15 CET).

Register Now