The steady growth of the green bond market has accelerated during 2021 and is set for a further boost as the European Commission (EC) takes another step towards establishing standards for green bonds.

The EC proposals are currently making their way through the exhaustive approval processes of the European Parliament and European Council, but that will not stop the EU raising significant sums this year, writes Commissioning Editor David Worsfold.

At a recent press briefing, Budget Commissioner Johannes Hahn (pictured) said the EU aims to raise €250bn in green bonds between now and the end of 2026. Around €80bn is planned for this year to support Europe's economic recovery from the coronavirus pandemic.

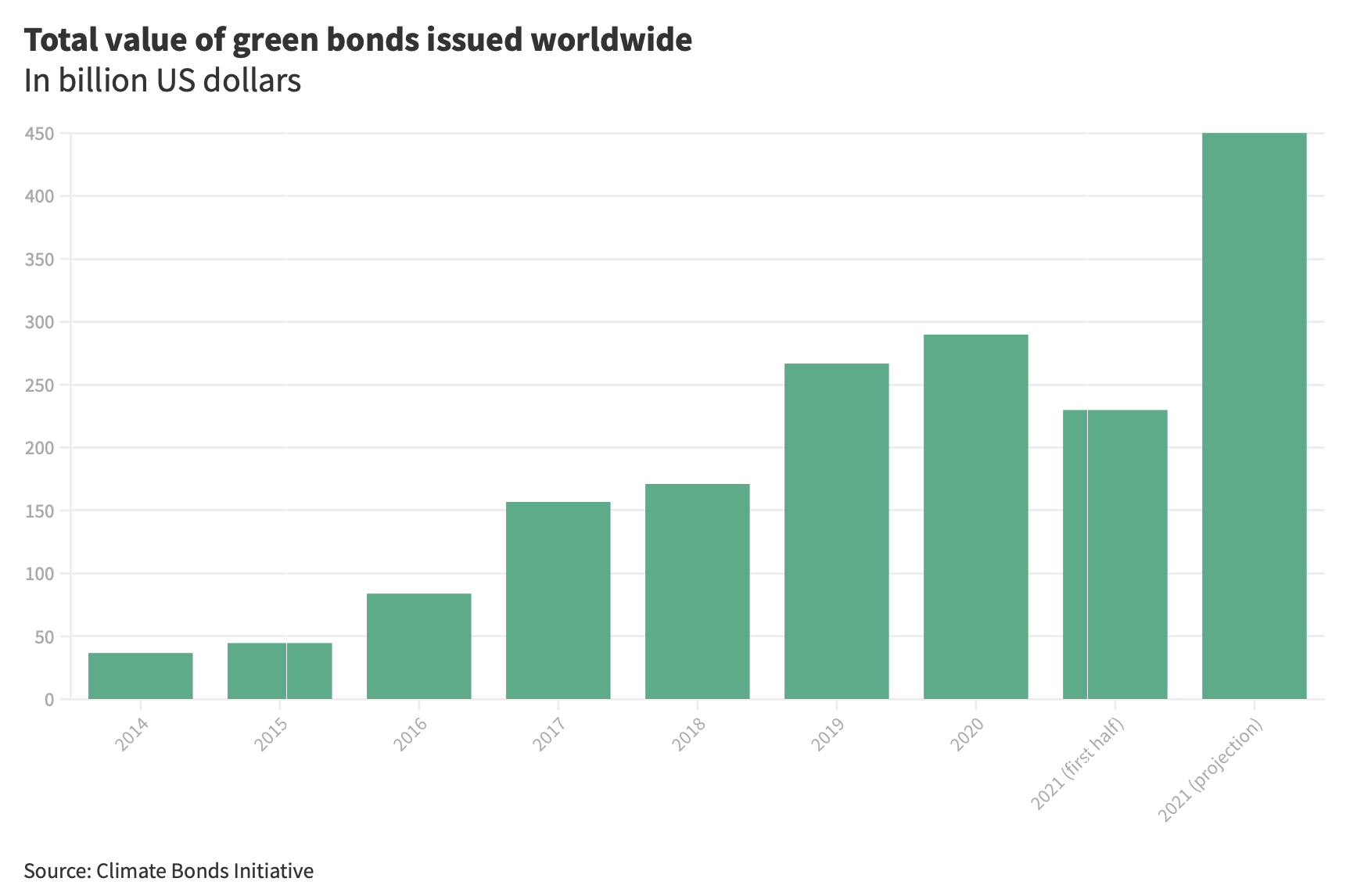

Bonds will be sold by monthly auctions, providing sustainable investors with "a predictable investment calendar," according to the commission, in a first step towards the goal of becoming the world's largest issuer of green bonds. It will ensure that 2021 accelerates towards being the biggest year for issuance of green bonds (see graph).

Bonds will be sold by monthly auctions, providing sustainable investors with "a predictable investment calendar," according to the commission, in a first step towards the goal of becoming the world's largest issuer of green bonds. It will ensure that 2021 accelerates towards being the biggest year for issuance of green bonds (see graph).

"Europe will lead by example," said Hahn, adding that "the new green bond framework will provide investors with the confidence that their investments are actually green." While the EU Gold Bond Standard (EUGBS) proposals are being debated, it will rely on the voluntary green bond principles developed by the International Capital Market Association.

The insurance industry has strongly welcomed the EUGBS proposals. Insurance Europe (IE) says the industry, as Europe’s largest institutional investor, supports measures to stimulate the development of the green bond market. It highlights several welcome feature of the EUGBS proposals:

- They can help enhance the availability of attractive sustainable assets.

- The framework will allow investors to invest in EU green bonds with confidence, on the basis of reliable, comparable and standardised information.

- Facilitate sovereign issuance of green bonds. This is important for funding the EU’s transition to a zero-carbon economy.

- They are based on market standards, making the EUGBS a potential global standard for green bonds in the future.

- It will be voluntary and does not prevent the use of other sustainability bond standards.

It will, however, be urging improvements when the proposals are debated in the EU institutions, including "grandfathering" so that outstanding EU green bonds, regardless of subsequent changes to the screening criteria of the EU taxonomy, remain EU green bonds. Support for projects that transition away from old energy must also be part of the standard, IE argues.

Finally, it warns that monopolistic market structures could increase issuance costs and could act as barriers to issuing green bonds. The accreditation criteria and supervision for EUGBS reviewers should therefore not result in situations in which ESG agencies hold market- and price-setting powers, such as in the credit rating agency market, says IE.

Getting the balance right will be a challenge, says law firm Sidley Austin: “The success of the EUGBS Regulation in facilitating the financing of green assets, and therefore accelerating the transition to a low carbon economy, will depend on whether in practice the right balance has been struck between having a tool that is sufficiently ambitious to avoid claims of “green-washing” and not imposing additional regulatory burdens to a degree that affects market uptake.”