Dave Ramsden, Deputy Governor, Markets and Banking at the Bank of England, used a speech to the Securities Industry conference to discuss the recent shocks that have hit the UK economy.

His analysis explored the reasons for recent market volatility and the likely impacts on the wider economy, making it clear that UK government policies have had a major influence, writes Contributing Editor David Worsfold.

Before turning to the bond market volatility, Ramsden (pictured) looked at some of the factors driving inflation in the UK, highlighting the energy price shocks and labour market trends where the UK stands out from global patterns of employment.

Before turning to the bond market volatility, Ramsden (pictured) looked at some of the factors driving inflation in the UK, highlighting the energy price shocks and labour market trends where the UK stands out from global patterns of employment.

“This looks like being one of the most significant economic legacies of the pandemic. Around the turn of the year there were signs that the recovery in the economy was bringing people back in to the labour market; a version of the ‘encouraged worker’ effect which is often seen during cyclical upturns.

“However these signs petered out, and by July 2022 there were about 500,000 fewer people classed as participating in the labour market than pre-pandemic. In this way the UK stands out compared with most other major economies. The UK participation rate is 0.7 percentage points lower than 2019 levels, whereas the median OECD country participation rate is 0.7 percentage points higher.”

He danced around the reasons for the tightness of the labour market in the UK, delicately avoiding mentioning Brexit. For the Bank, the main concern is how this will feed through to pay, with expectations of continued high inflation already driving up wages.

On bond market volatility, Ramsden was clearer in his analysis of cause and effects.

“The final shock I want to talk about is the recent turbulence in financial markets. The MPC’s [Monetary Policy Committee] forecasts are conditioned on assumptions for the outlook for various asset prices and so these movements could have a significant direct effect on the November forecasts and for the Committee’s broader assessment of financial conditions.

“Financial markets globally have been volatile over recent months, with notable rises in government bond yields, large moves in exchange rates and falls in risky asset prices. Overall the adjustment in market prices has been consistent with tighter monetary policy globally and the deterioration in the economic outlook.

“These trends were more marked for the UK through August and up to the September MPC meeting. But the UK began to really stand out over the last fortnight, which has seen significant moves in the pricing of UK financial assets. Part of that re-pricing continues to reflect broader global developments. But there is undoubtedly a UK-specific component.

“The sterling exchange rate in ERI terms has fallen by 7% since the start of the year, partly in the context of a strong dollar, but while it has continued to be volatile it is broadly unchanged since the September MPC meeting.

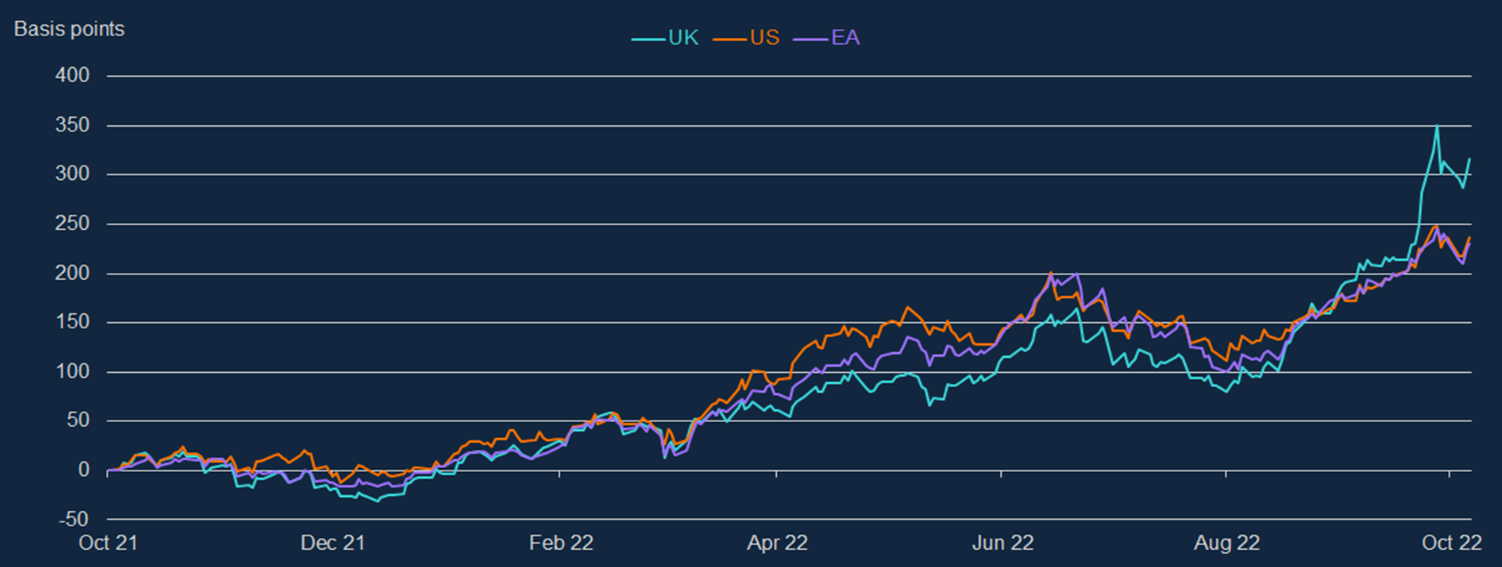

“Recent moves in the prices of government bonds, gilts, have been more striking. At the benchmark 10 year point, yields have risen steadily through the year globally.” (Chart 4)

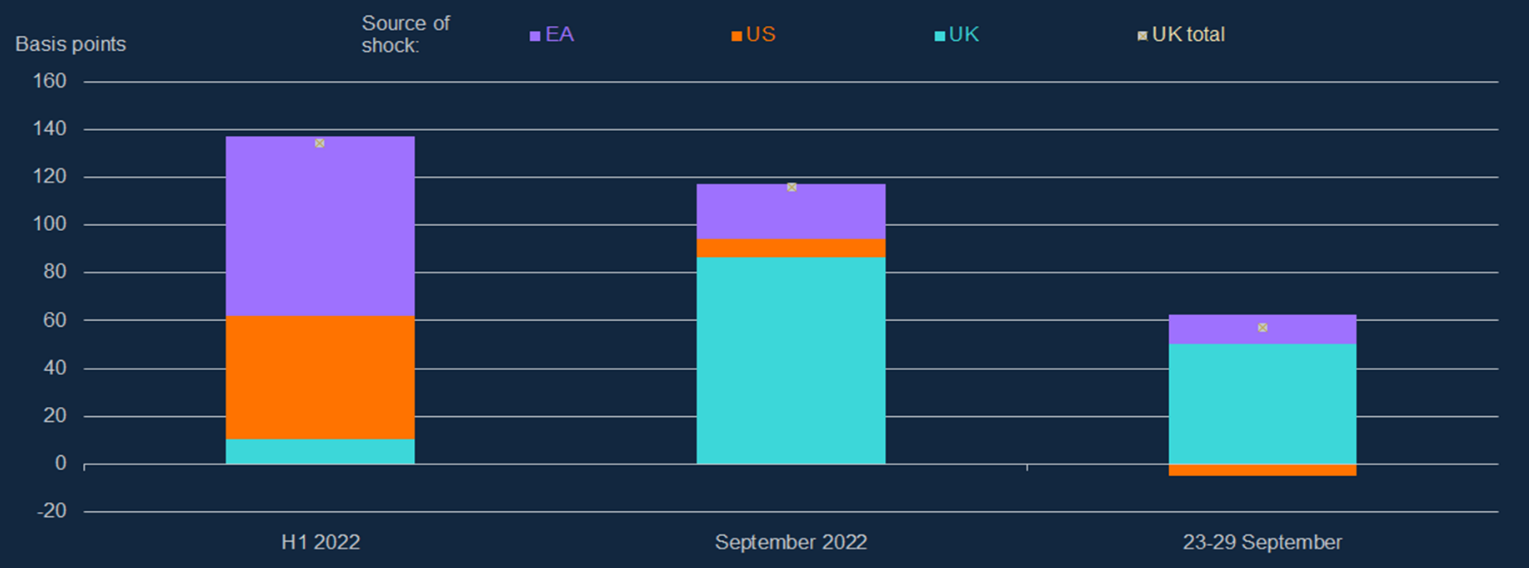

“But having tracked US and Euro area yields since the start of the year, UK yields have risen more markedly through August and especially sharply over the last fortnight since the announcement of the Government’s Growth Plan. Decompositions of the drivers of the shock to yields point to domestic UK factors as driving the increase over the most recent period, which is unusual.” (Chart 5)

Read Dave Ramsden’s full speech

Read Dave Ramsden’s full speech