The view that the UK is the sick man of the G7 economies when it comes to growth is misplaced, with key data on growth and trade showing the UK firmly in the middle of the major economies, according to Simon French, chief economist at Panmure Gordon.

There are causes for cautious optimism, especially around demographic trends and the mix of short and long public debt, French said at a briefing for the UK section of the Association of European Journalists at Regent's University, reports Contributing Editor David Worsfold.

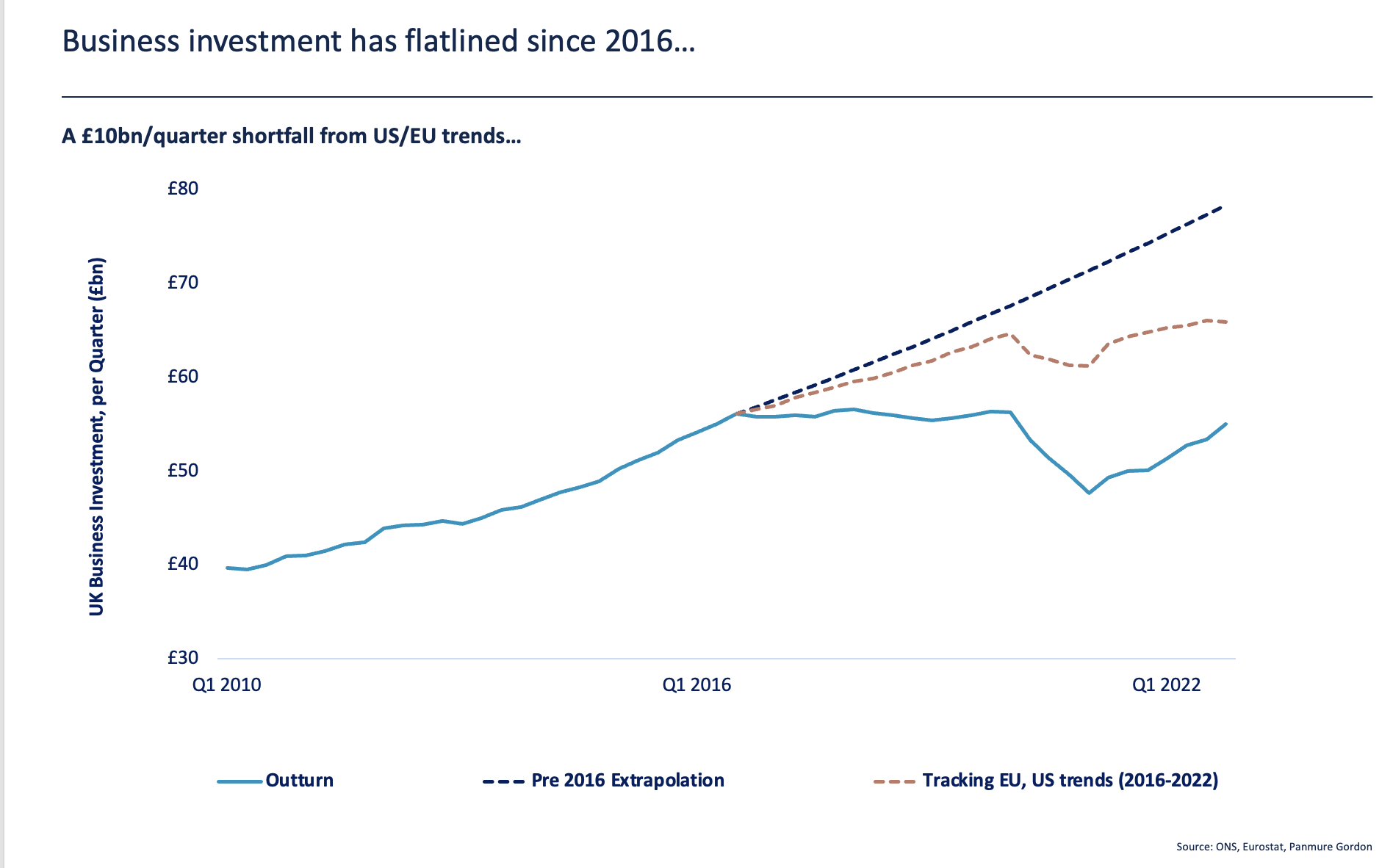

He acknowledged that Brexit was still casting a long shadow across the UK economy with the biggest impact felt on business investment, whuich has taken a hit of £10bn a quarter since Brexit (see slide 1). This has exacerbated negative perceptions around the value of British companies, with concerns about productivity creating a significant drag on values.

He acknowledged that Brexit was still casting a long shadow across the UK economy with the biggest impact felt on business investment, whuich has taken a hit of £10bn a quarter since Brexit (see slide 1). This has exacerbated negative perceptions around the value of British companies, with concerns about productivity creating a significant drag on values.

Depressed levels of businesses investment have been a longer-term trend pre-dating Brexit, he said.

“The UK has under-invested for decades and that is now having an impact and is going to take several years to turn around”. Lack of investment is now showing in poor productivity compared to our major competitors, further depressing valuations.

With the US and Europe looking to stimulate growth through major public investment programmes, especially in the green economy, we should expect a competitive response from the UK government, said French.

He sounded a stark warning over UK equities and the prospects for London as a preferred market for listing. London is seen as a “Jurassic Park stock market”, he said, with too many old companies focussed on producing dividends for shareholders and not focussed on growth: “For a long-time the UK has been the home for ex-growth companies”.

While the headlines have been grabbed by some companies deciding to move their listing from London to New York, he said we should be looking elsewhere for the competitive challenges. Many tech firms looking to raise money, especially those producing semi-conductors, have shunned London in favour of Amsterdam.

Offsetting this trend is the volatile interest rate environment. Insurgent brands – many funded by private equity – “will take a hit as a result of higher interest rates” … “this will mean incumbents come back in fashion”.

Sterling has also been impacted by Brexit, although this is not seen by everyone as being negative. French said some leading figures, such as former Governor of the Bank of England, Mervyn King, argue that the Pound was over-valued before Brexit.

Overall, French said “there is a clear scarring impact from global investors taking a dim view of the UK economy”.

“I don’t think it is contentious to say the UK economy is in a poorer place as a result of Brexit”.

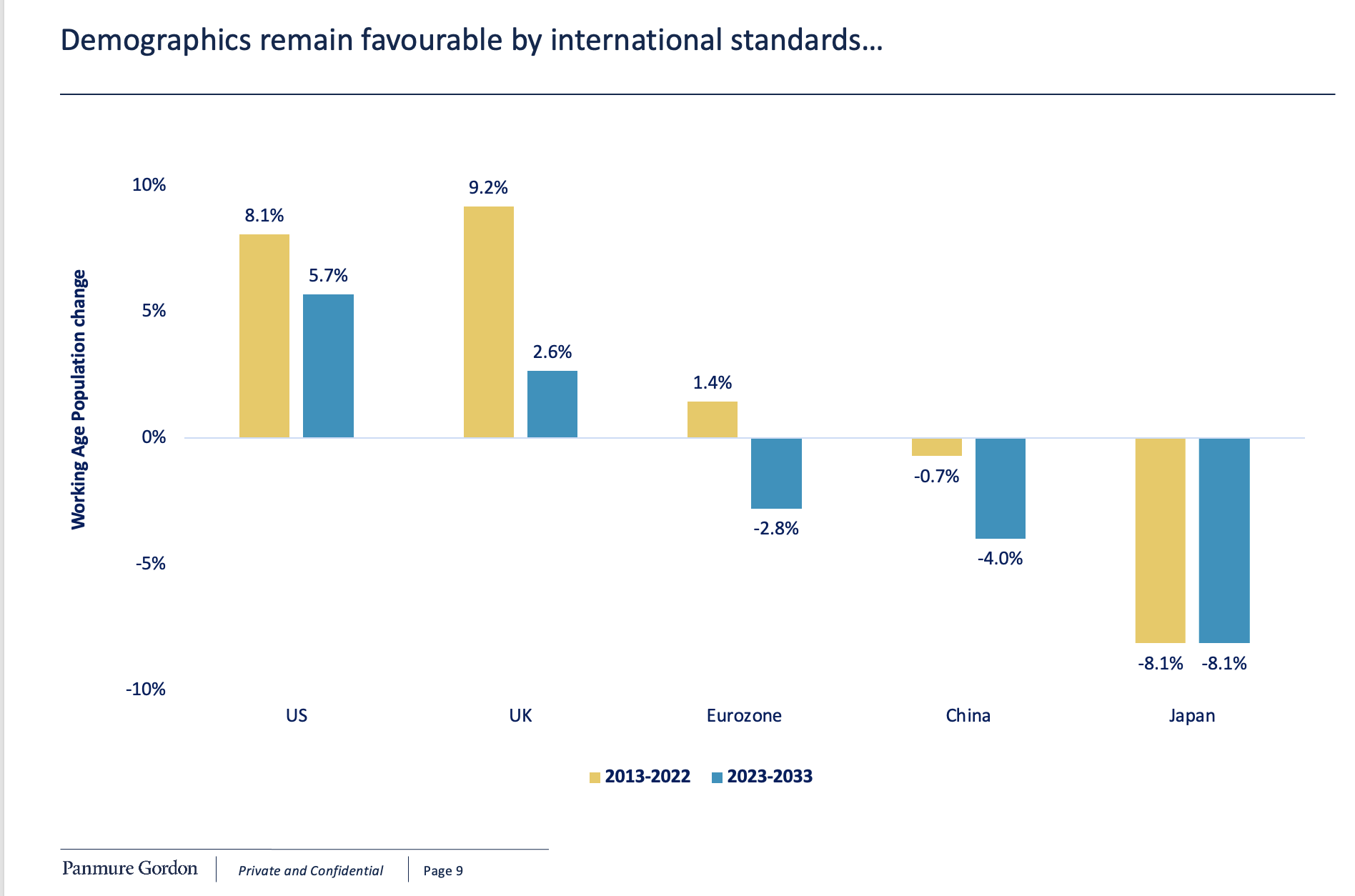

It is not all doom and gloom. There are positive trends around demographics and long-term debt.

The working age population in the UK has grown faster than other major economies over the last decade and, although the rate of growth is set to slow over the next ten years, it will still grow. At the same time, the Eurozone, China and Japan, will all see their working age populations contract (see Slide 2). This inhibits growth and places a strain on public finances as the cost of supporting an aging population escalates.

The working age population in the UK has grown faster than other major economies over the last decade and, although the rate of growth is set to slow over the next ten years, it will still grow. At the same time, the Eurozone, China and Japan, will all see their working age populations contract (see Slide 2). This inhibits growth and places a strain on public finances as the cost of supporting an aging population escalates.

Public debt is also not the problem that many politicians suggest, said French.

As a percentage of gross domestic product (GDP) UK public debt is high by international comparisons. It is also more resilient to the current shocks being felt from interest rate rises as a significant proportion of UK debt is very long-dated, so does not need to be re-financed with new debt incurring higher interest rates.

He was dismissive of the obsession with public sector debt: “Debt limits are unhelpful in deciding whether a country is running its economy well or running it badly.”

Regulatory arbitrage is also another potential advantage for the UK with the post-Brexit loosening of some regulatory controls on the financial services sector the so-called Edinburgh Reforms – holding out the prospect of creating a competitive advantage which could attract more business into the City of London.

This path has its dangers, however.

“If you are planning to re-join the Single Market you shouldn’t be pursuing regulatory arbitrage … You cannot have those mutually exclusive statements floating about and remain credible.”