Across Europe insurers are still nervously watching macro-economic trends and market volatility, fearful of more unexpected adverse movements, according to the European Insurance and Occupational Pensions Authority (EIOPA).

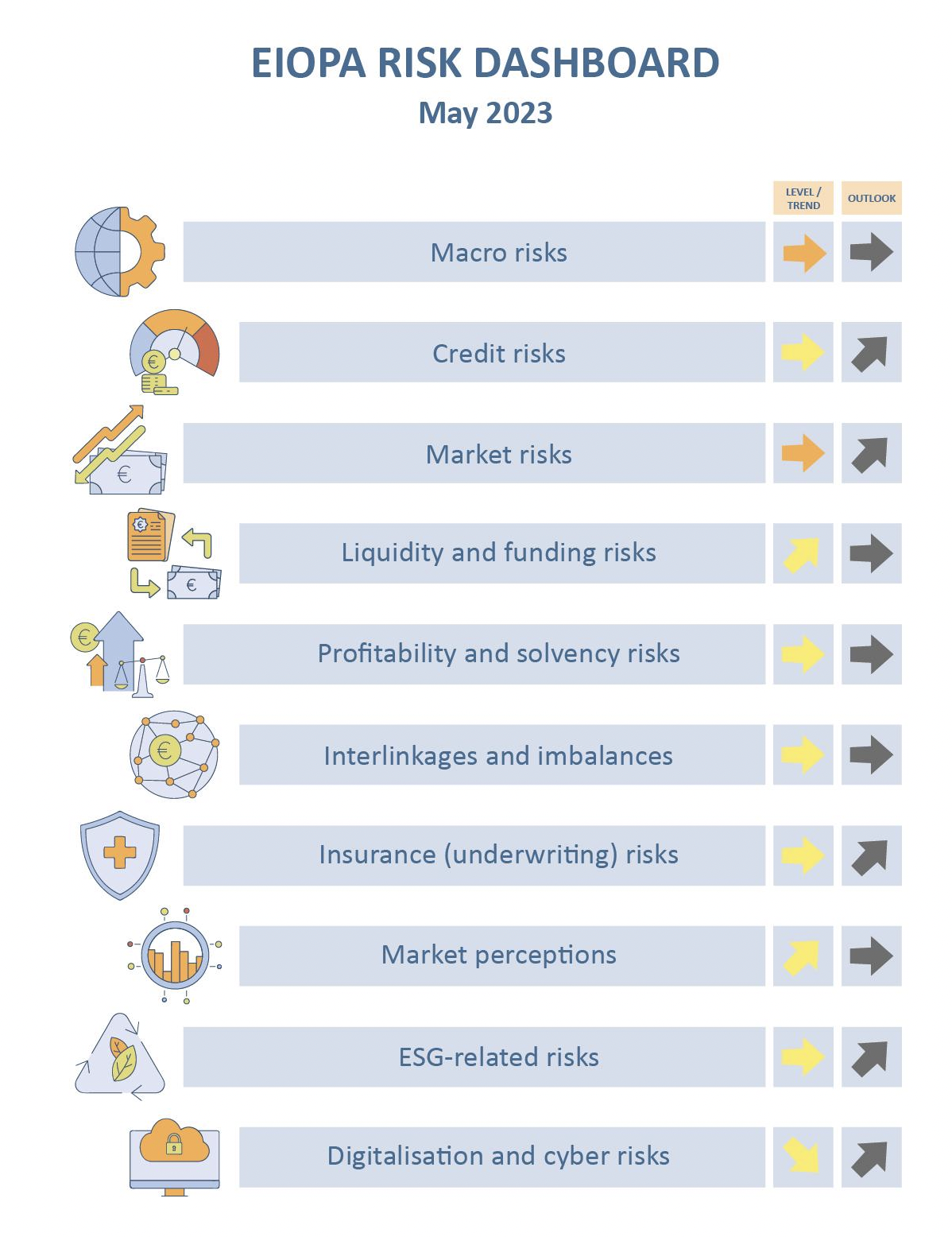

The pan-European regulator’s latest Risk Dashboard, based on Q4 2022 Solvency II data, highlights these as the main concerns for the insurance sector. Other risk categories remain at medium risk levels, although the outlook for ESG, credit and cyber risks is pessimistic, writes Contributing Editor David Worsfold.

The data used in compiling the dashboard is based on the financial stability and prudential reporting collected from 97 insurance groups and 2181 solo insurance undertakings. It is broken down into ten categories (see box).

The report summarises each risk category and provides detailed insights.

Macro-related risks remain among the most relevant for the insurance sector. Forecasted GDP growth at global level further increased to 0.53%. Consumer price index (CPI) forecasts hover around the high level of the latest assessment. Unemployment rates for the main geographical areas remained at low level. The weighted average of 10 year swap rates remains at higher level. Fiscal balances have deteriorated. The credit-to-GDP gap slightly increased. Central banks continue their contractionary monetary policy.

Macro-related risks remain among the most relevant for the insurance sector. Forecasted GDP growth at global level further increased to 0.53%. Consumer price index (CPI) forecasts hover around the high level of the latest assessment. Unemployment rates for the main geographical areas remained at low level. The weighted average of 10 year swap rates remains at higher level. Fiscal balances have deteriorated. The credit-to-GDP gap slightly increased. Central banks continue their contractionary monetary policy.

Credit risks remain at medium level. The CDS spreads increased for financial unsecured bonds in the first quarter of 2023, after the recent turmoil in the banking sector, while insurers’ median exposure this asset class had increased in Q4-2022. The median average credit quality of insurers’ investments remained stable, however it deteriorated for the top percentile of the distribution. The median share of below investment grade assets (with a credit quality step higher than 3) in insurers’ portfolios decreased.

Market risks remain at high level. Volatility in the bond market increased and equity markets remained at higher level compared to the previous assessment. The median for the indicator on the concentration of assets decreased.

Liquidity and funding risks remain at medium level with an increasing trend. Cash holdings reported a drop in the last quarter of 2022. On the other hand, lapse rates increased.

Profitability and solvency risks remain at medium level. Life insurers reported an increase in their SCR (solvency capital requirement) ratio, while the SCR ratio of non-life insurers experienced a slight decrease. Return on assets and return to premiums increased. The net combined ratio (for non-life insurers) deteriorated.

Interlinkage and imbalance risks remain at medium level. Although to a lower extent, insurers continued realizing market to market losses on those derivatives positions aimed at hedging interest rates declines. The exposure to banks and other financial institutions increased.

Insurance risks remain at medium level. The year-on-year premium growth for life insurance continued decreasing reaching the negative territory for the second consecutive quarter.

Market perceptions remain at medium level. Insurance life stocks overperformed, while non-life underperformed the market. The median price-to-earnings ratio of insurance groups increased. The median of CDS spreads of insurers slightly decreased. Insurers’ external ratings remained broadly stable since the last assessment.

ESG related risks remain at medium level. The median exposure toward climate relevant assets slightly increased to 3.2 % of total assets. The share of insurers’ investment in green bond over total green bonds outstanding slightly decreased compared to the previous quarter. The year-on-year growth of green bonds outstanding slightly decreased, while the median growth of insurers’ investment in green bonds increased.

Digitalisation and cyber risks are at medium level. The materiality of these risks for insurance as assessed by supervisors remains high. The frequency of cyber incidents impacting all sectors of activity, as measured by publicly available data, decreased since the same quarter of last year. Cyber negative sentiment indicates a continuing high concern in the first quarter of 2023.