The challenges of aligning portfolios with ambitions to achieve net zero carbon emission targets are significant but can be faced, Claire Bews, senior credit portfolio manager at Insight Investment, told a recent Insurance Investment Exchange roundtable.

Speaking to IIE Contributing Editor David Worsfold after the event she expanded on this and some of the other issues raised at the roundtable. Key among these were the doubts many insurers have that striving for ambitious net zero targets is difficult to marry with the need to deliver returns comparable to traditionally constructed portfolios.

“I think this is a conundrum we haven’t solved yet. However, enough of the investment universe has made clear commitments such that we can build portfolios that are committed to net zero but also deliver consistent, comparable returns.”

“I think this is a conundrum we haven’t solved yet. However, enough of the investment universe has made clear commitments such that we can build portfolios that are committed to net zero but also deliver consistent, comparable returns.”

This is far from an exact science. Many issuers are making bold statements about their intended journeys to net zero: some will deliver but others will not.

“We are very aware of that and we are already seeking to actively monitor what steps issuers are taking towards achieving their net zero targets. This requires ongoing dialogue with clients especially where we find we cannot achieve an insurer’s net zero targets in the short-term, without significantly impairing returns”.

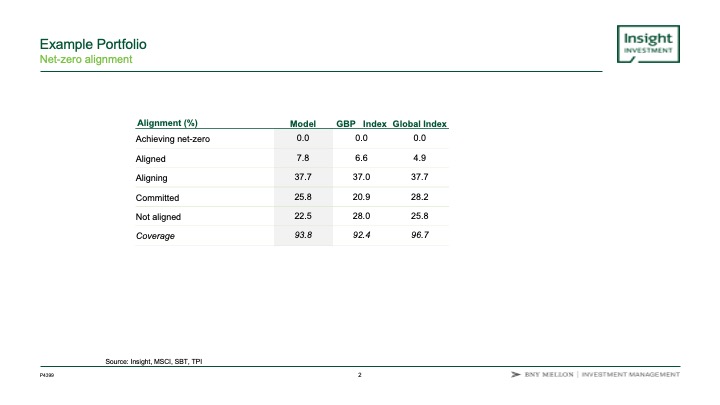

That dialogue focusses on categorising issuers by their degree of alignment with the net zero targets being set by governments and regulators. The key tools for doing this have been developed by the Institutional Investors Group on Climate Change (IIGCC) and they categorise firms from ‘Achieving Net Zero’ down to ‘Not aligned’ (see table). This is far from just a subjective judgement, says Bews.

“We use data from multiple sources to categorise issuers but it is about taking a realistic view on whether they will deliver on their ambitions to align with the targets. If an issuer has the potential to commit, and demonstrates a willingness to do so, we will typically hold onto them in the short term.

“We then look at those commitments, how strong they are and look for evidence on movement before moving them up a category.

“There is a strong quantitative element to this”, but it is important to avoid falling into the trap of greenwashing, says Bews.

“There is a risk of some of the issuers saying they have a commitment to net zero by 2050 but haven’t put any meat on the bones.

“To get beyond these high level commitments there have to be clear numerical targets, especially around reaching Scope 1 and Scope 2 targets.” (see below)

“12 months ago we were urging caution when using carbon data because we did not have full confidence in the data. We are now beyond that. There is more consistency across the data and there are very few outliers.”

The data is not perfect yet, however: “Scope 3 numbers are still very, very difficult to calculate for certain industries and especially for smaller issuers”.

That said, any issuers coming into the Sterling and European credit markets without at least reporting their Scope 1 and Scope 2 emissions and the likelihood of a net zero target are becoming impossible to invest in, because portfolio owners want to see a net zero commitment as they need to report to shareholders and regulators. Increasing scrutiny by the latter is a key concern for our insurer clients and prospects.

There are important nuances in managing these demands, especially around the transition from fossil fuel dependency to clean energy, a major challenge for many historically important issuers.

“Have they got credible plans in place with credible targets and are the meeting them? Just disinvesting doesn’t bring about the scale of change required, so ongoing engagement is crucial here”, says Bews.

This is good as far as it goes but it needs to go further: “It feels to me that investors and the asset management sector have focussed on climate risks and in particular on carbon data. But there is a consensus emerging now that we should be reporting more data particularly on biodiversity. This is coming with the growing influence of TNFD [Task Force on Nature-related Financial Disclosures] which will mean more data on biodiversity starts to become available.

Categorising emissions

- The Greenhouse Gas Protocol – which provides the most widely recognised accounting standards for greenhouse gas emissions – categorises GHG emissions into three ‘scopes’.

- Scope 1 covers direct emissions from owned or controlled sources.

- Scope 2 covers indirect emissions from the purchase and use of electricity, steam, heating and cooling. By using the energy, an organisation is indirectly responsible for the release of these GHG emissions.

- Scope 3 includes all other indirect emissions that occur in the upstream and downstream activities of an organisation.