The Bank of England has been expressing quiet satisfaction about its quantitative tightening (QT) programme. It is on course to reduce the stock of gilts held in the Asset Purchase Facility by 11.6% by the end of the first year of the programme in September.

Fears of a repeat of the “taper tantrum” that greeted the US Federal Reserve’s attempts to do the same back in 2103 have not materialised and all the data says that QT has had a very limited impact on yields, volatility and liquidity, writes Contributing Editor David Worsfold.

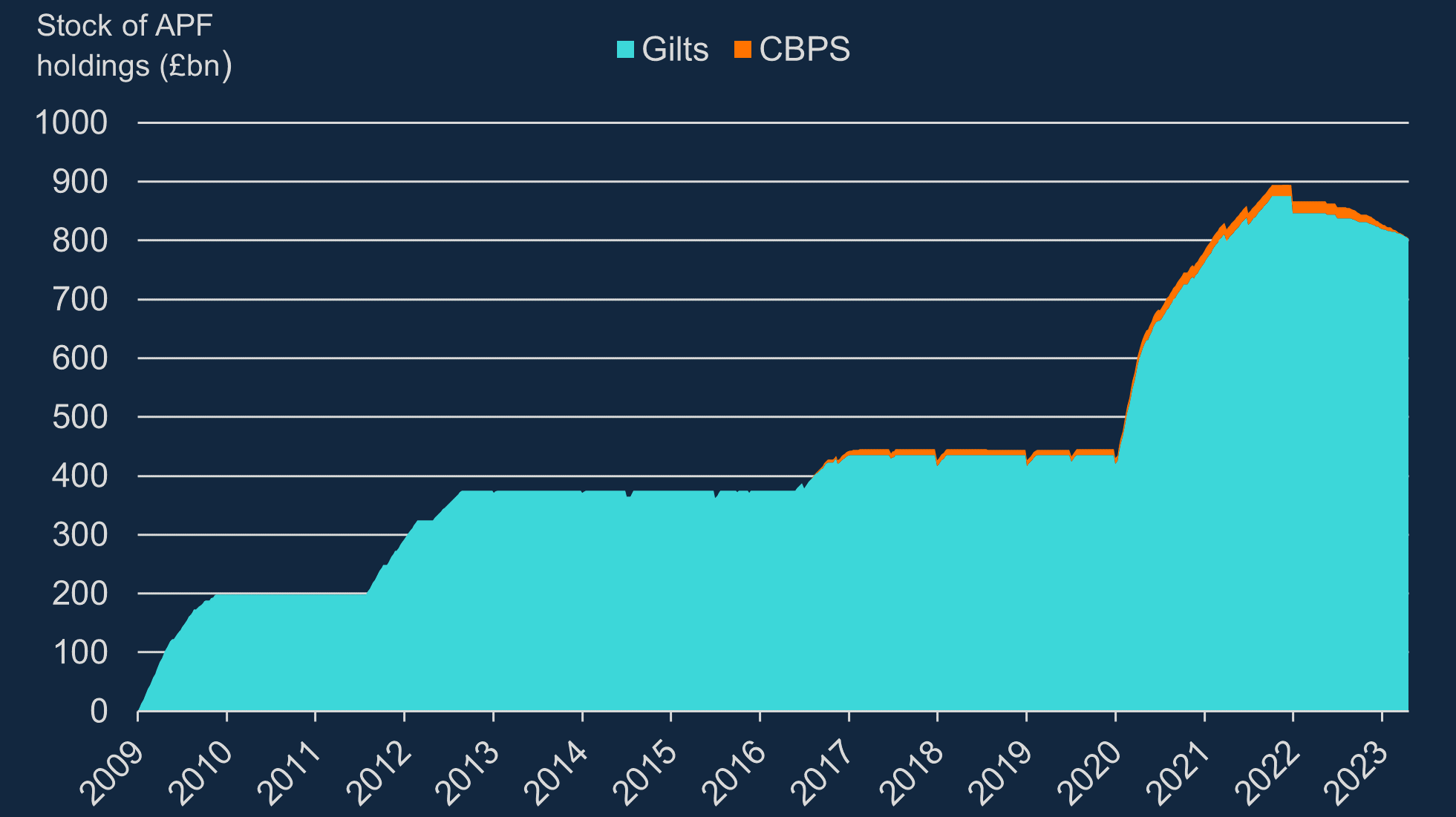

The stock of assets held in the APF peaked at £895bn towards the end of 2021 as QE was ramped up in in response to the Covid-19 crisis and its aftermath. The vast majority – £875bn – was UK government debt, amounting to around a third of the total gilts in issue, and of annual UK GDP. The remainder of the MPC’s QE portfolio comprised around £20bn of UK corporate bonds. (Chart 1)

Dave Ramsden, deputy governor for markets and banking, says this success has been built on three principles.

- Use of Bank Rate as its active policy tool when adjusting the stance of monetary policy

- Sales would be conducted so as not to disrupt the functioning of financial markets

- Sales would be conducted in a relatively gradual and predictable manner over a period of time

He told a conference at the Bank at the end of July that these principles will continue to inform the promised one-year review of the programme by the influential Monetary Policy Committee (MPC) at the end of September:

“The review will inform the MPC’s decision on the pace of QT. That decision will be framed by the MPC’s key principles; in particular, that QT is not the active tool for monetary policy. The Committee has a preference to use Bank Rate as its active policy tool when adjusting the stance of monetary policy. For me this means that QT should be thought of as operating in the background.”

The programme’s impact on yields has been limited, according to Ramsden:

“Our market intelligence suggests that QT, while likely having some impact on yields, has had a relatively small role to play. For example, in the June 2022 Market Participants Survey, conducted by the Bank, the median respondent reported that QT expectations had pushed up UK gilt yields by 10bps for the UK 10 year gilt and ongoing market intelligence conversations suggests that the impact on yields remains small.”

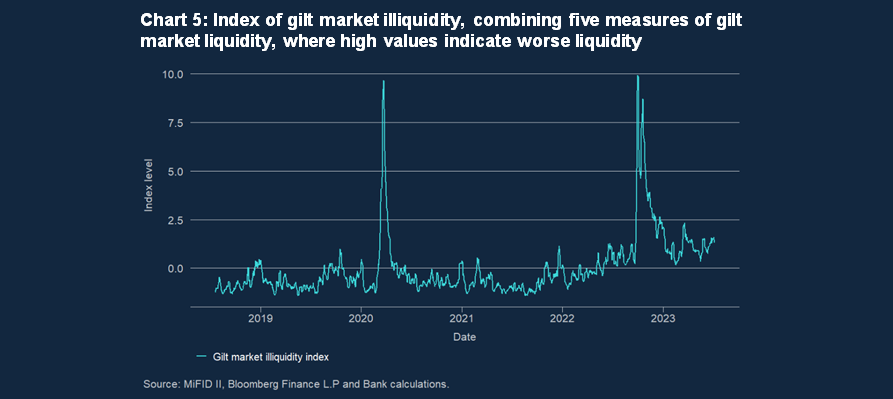

Liquidity has been another key measure that the Bank has been monitoring and there the picture is more mixed, mainly because of events beyond the Bank’s control.

Market conditions deteriorated rapidly in the wake of the calamitous Truss/Kwarteng budget last September, just as the QT programme was getting underway. Measures of gilt market illiquidity spiked, reaching similar levels to the 2020 pandemic inspired “dash for cash”. Conditions quickly improved in late 2022 and into the New Year, before deteriorating again following the failure of Silicon Valley Bank in March and the associated increase in volatility. (Chart 2)

“Liquidity conditions have since improved overall. Some metrics remain somewhat higher than their average over previous years, but this is broadly as expected in the context of the higher level of volatility”, said Ramsden.

One aspect of the programme that the Bank views as a particular success is the exit from corporate bonds, a holding which stood at £20bn this time last year.

The Bank believed that the impact on monetary conditions at a time when markets were functioning relatively normally was likely to be small as so stopped reinvesting in the Corporate Bond Purchase Scheme in February 2022, with the sales from the portfolio starting in September 2022.

“This process went well”, said Ramsden. “Our sales operations were designed to be responsive to market demand and we sold the corporate bond portfolio ahead of target. Sales were completed on 6 June 2023, well ahead of the initially expected pace”.

A small number of very short maturity bonds will continue to be held in the portfolio, maturing fully by 5 April 2024.

Hailing the programme as “so far, so good”, Ramsden said he expects to continue along the same lines for the rest of this year and into 2024”

“We can of course never be complacent and will continue to monitor market functioning closely. But so far, this has all been achieved by applying the three key principles for QT that the MPC set out almost two years ago.”