The extent to which insurers in the European Economic Area (EEA) invest in a range of investment funds – significantly ahead of government bonds – is revealed in the latest data snapshot published by the European Insurance and Occupational Pensions Authority (EIOPA). It also exposes the reluctance of insurers scross the continent to plough investments into infrastructure.

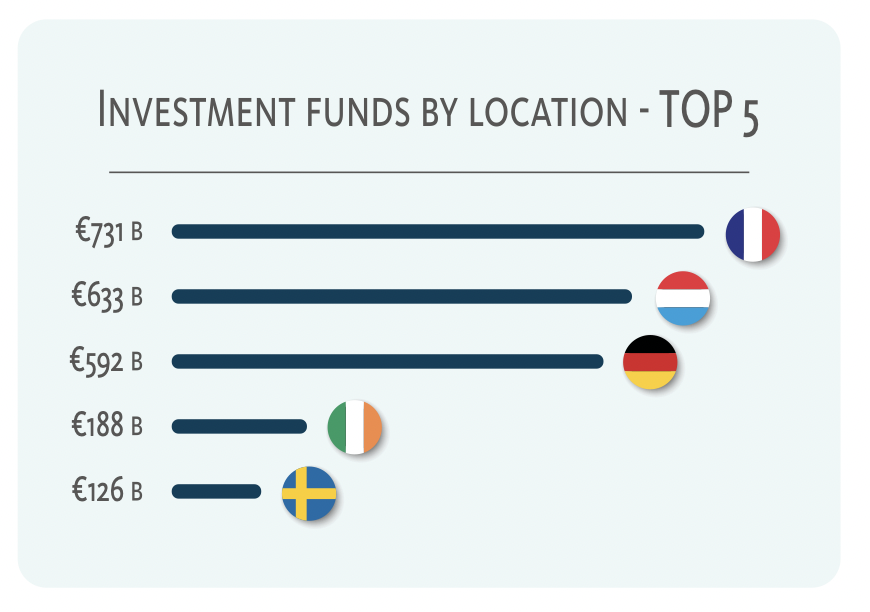

Equity and debt funds take the lion’s share of this investment, with France the leading domicile. France also leads Germany when it comes to insurer investments into government bonds and corporate bonds and is close to overhauling Germany when it comes to equity investments too, writes Contributing Editor David Worsfold.

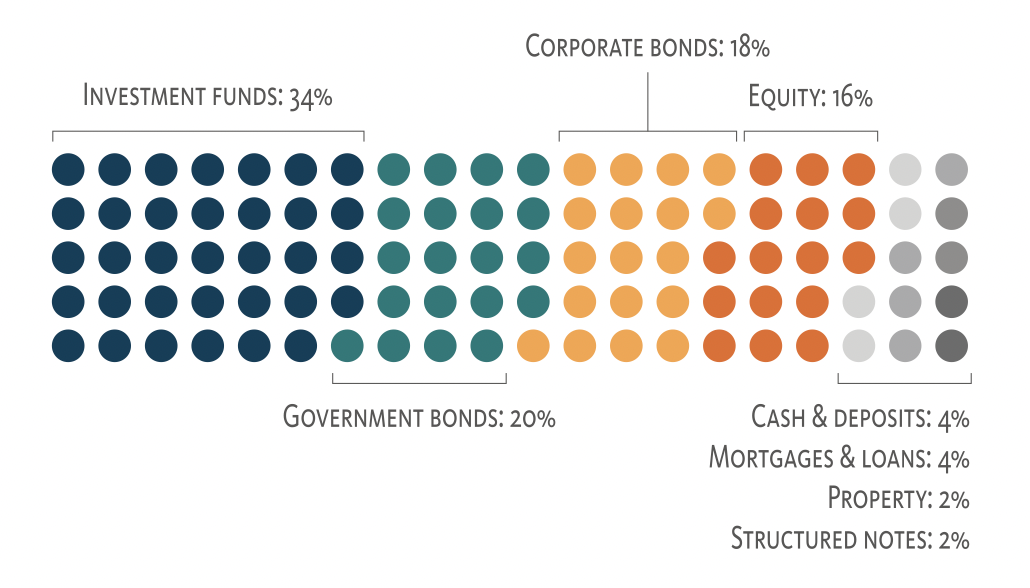

EIOPA collected comprehensive statistics on the assets and liabilities of 1729 (re)insurers active in the European Economic Area. This revealed that as of Q1 2023, EEA (re)insurers held €8.57tr in assets. Most of these assets are allocated to investment funds, government bonds, corporate bonds and equity. These four categories together make up 88% of all investments, although equities attract only 16% with just €22bn out of €1.36tr of funds finding its way into UK equities. The remaining 12% of the assets is held in cash or invested in mortgages and loans, property and structured notes (Chart 1). Just 2% is held in cash and deposits.

EIOPA collected comprehensive statistics on the assets and liabilities of 1729 (re)insurers active in the European Economic Area. This revealed that as of Q1 2023, EEA (re)insurers held €8.57tr in assets. Most of these assets are allocated to investment funds, government bonds, corporate bonds and equity. These four categories together make up 88% of all investments, although equities attract only 16% with just €22bn out of €1.36tr of funds finding its way into UK equities. The remaining 12% of the assets is held in cash or invested in mortgages and loans, property and structured notes (Chart 1). Just 2% is held in cash and deposits.

EIOPA also highlighted the strong position of Luxembourg as a destination for money flowing into investment funds (Chart 2).

One figure that will attract the attention of EIOPA and European Union policymakers as they enter the final phase of shaping the revised Solvency II regime is the tiny amount of the €2.95bn ploughed into investment funds that finds its way into infrastructure funds – just 2.3%. With one of the primary objectives of policymakers and governments across Europe being to attract more institutional investment into infrastructure this figure will be a disappointment and will strengthen their determination to use the reforms to push more money into infrastructure.

European insurers do not look kindly on UK government bonds. Of the €1.71tr invested in government bonds, the UK attracted only €10bn, placing it 16th behind Ireland (€18bn), Portugal (€18bn), Denmark (@16bn), Canada (@16bn) and Finland (€12bn). The big three were France (€436bn), Italy (€313bn) and Germany (€194).

For a deep dive into the data behind this snapshot visit the statistics section of the EIOPA website

- The EEA consists of the 27 members states of the European Union plus Iceland, Liechtenstein and Norway.