The complex relationship between non-bank risks and private credit, especially in the higher interest rate environment, is firmly in the Bank of England’s financial stability spotlight.

The expansion of private credit as a source of funding for corporates on both sides of the Atlantic since the global financial crisis has been very significant. In broad terms, it now accounts for around half of UK and global financial assets. It has become an alternative source of financing for corporates and other asset classes such as real estate. Often, the choice has been forced on them because they have found it difficult to secure fiancé through the public markets or from banks, writes Contributing Editor David Worsfold.

This was the background to a presentation by Lee Foulger, Director of Financial Stability, Strategy and Risk at the Bank of England, at the recent Deal Catalyst/AFME direct Lending and Middle Market Finance Conference.

He said private credit matters to the real economy as it contributed approximately £425bn in lending to UK business between 2008 and 2023.

“That means it is important that, alongside banks, the non-bank system can absorb, and not worsen, any shocks that may arise”, said Foulger.

No hostility to private credit

This does not mean the Bank is hostile to this growth or wishes to restrain it. Its focus is on understanding it, quantifying the risk and sharing that intelligence with the market participants.

“The increasing role played by non-bank finance in the provision of credit is a feature of the financial system, not a bug, and a welcome feature if undertaken on a sustainable basis. It has grown particularly strongly following the global financial crisis alongside the tightening of regulations for the banking system, and a period of unusually low interest rates globally.

“The shift in the risk environment, including greater geopolitical risks, more subdued economic growth, and tighter financing conditions will pose challenges to the non-bank sector and specific challenges to private credit markets, both in terms of the way risks are managed and because the underlying borrowers and the specific business models are likely to be increasingly challenged in this environment.”

Breaking down the risks

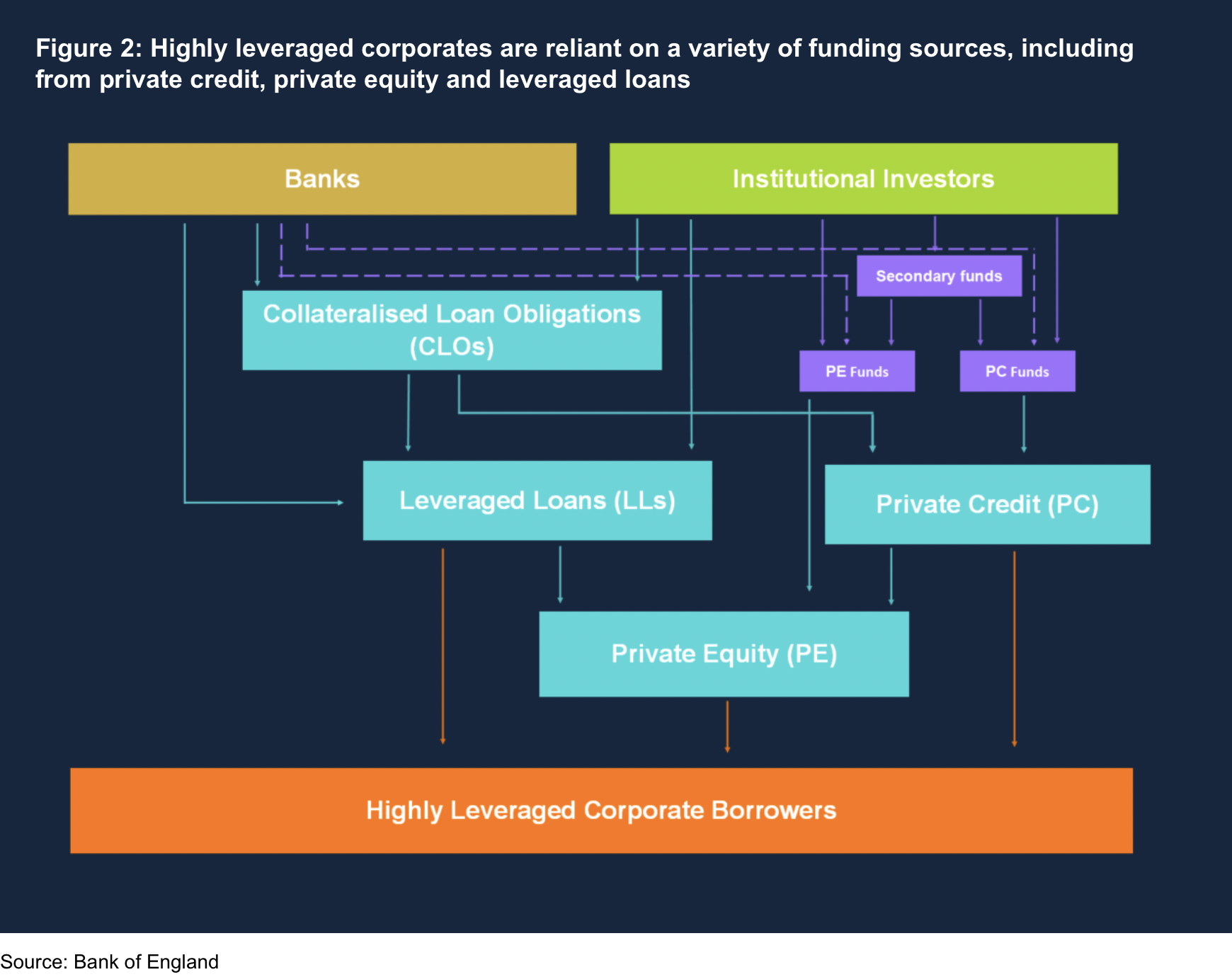

The Bank breaks the risks down into two broad categories: “microfinancial vulnerabilities” and “macrofinancial vulnerabilities”

The former are “risks inherent in the business models of market participants, that they must manage and for which it is generally in their own interests to get right.”

It is the latter that has had the Bank pouring over the patchy data to enable it to create a clearer picture of the potential risks it poses to financial stability.

“These are risks inherent to the structure of markets, or the collective behaviour of individual firms within them. They include issues such as market concentration, jumps to illiquidity, correlation and interconnectedness. For example, high market concentration can amplify price moves and increase the risk of disruption, especially where firms’ liquidity demands are large compared to the system’s ability to supply.”

The September 2022 crisis over liability driven investment (LDI) was an example of the risk being played out in reality.

Teasing out the connections is key to understanding the risks, said Foulger.

“Interconnectedness across markets, when combined with opacity, can result in losses being transmitted to counterparties in a sudden or surprising way, driven in part by the lack of certainty on overall positions held in the market. For example, during the financial crisis, the interconnectedness and lack of transparency of derivative markets amplified shocks in the financial system. In private markets, these interlinkages could include, cross-investing between investors and funds, with some large fund managers exposed to other private credit and private equity funds.” (see figure1).

Managing the risks surrounding private credit investments could also be made more difficult by the illiquid nature of the asset class” Some private credit funds may have a degree of liquidity mismatch between their investments and the redemption terms of their investors.”

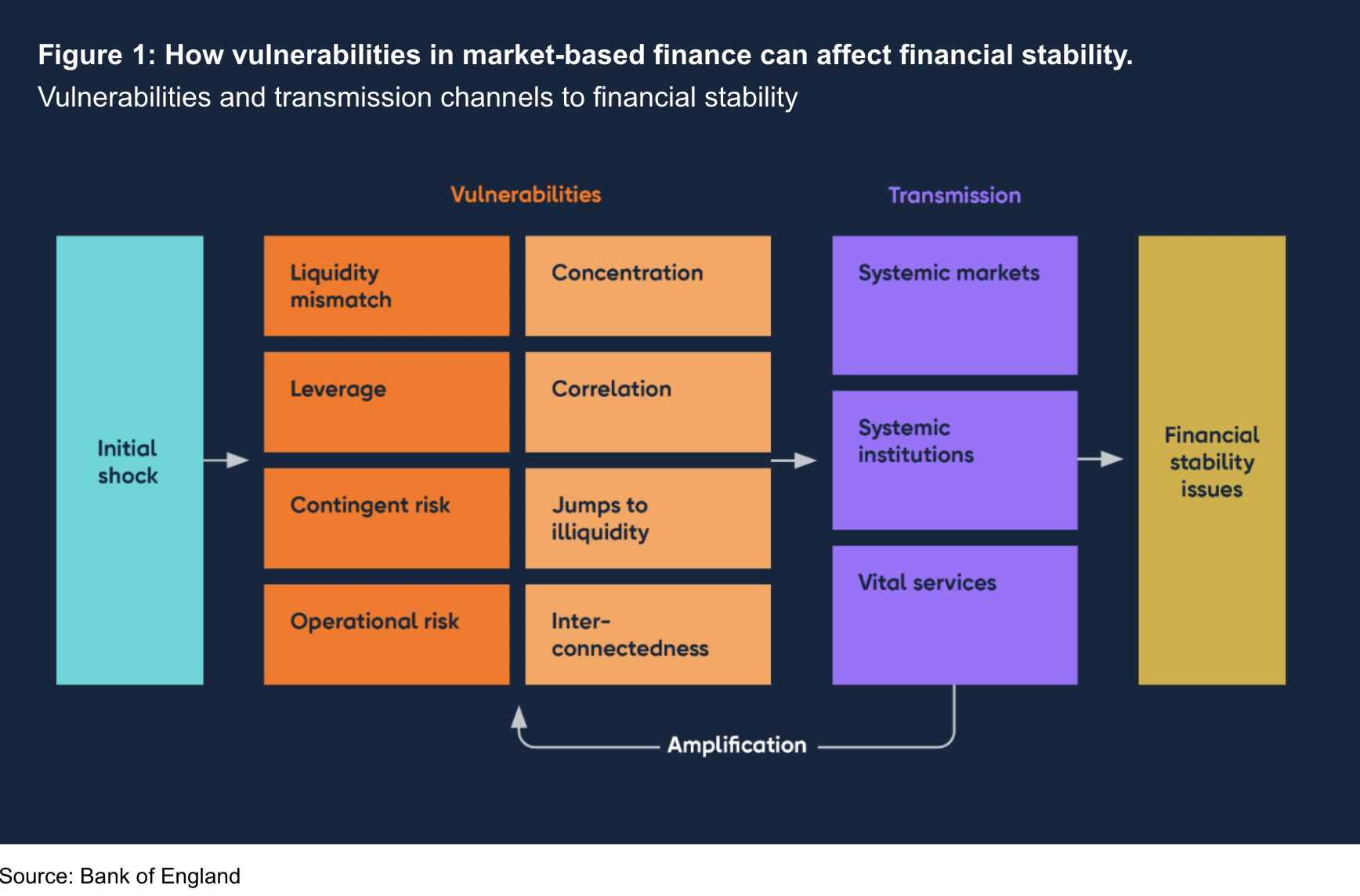

The significant interlinkages between private credit markets, leveraged lending, and private equity activity make them vulnerable to correlated stresses. Private credit and leveraged loan markets are interlinked given their floating rate nature and links to private equity activity (see figure 2).

“Private credit exposures are largely held by a range of institutional investors. Leveraged loan and private credit markets exhibit some overlap in investor bases. Given the illiquidity of private credit assets, there is a possibility that investors may opt to sell other, comparatively more liquid assets, such as leveraged loans or high-yield bonds to reduce their credit exposures.”