As the dust settles on the landmark US Presidential election, insurer investment teams will be pondering the impact of Donald Trump's unpredictable administration.

A key focus in this assessment will be the implications on the core fixed income strategies which have remained at the heart of institutional investment strategies, despite the search for yield among all manner of alternative investments during the low interest rate decade, writes Contributing Editor David Worsfold.

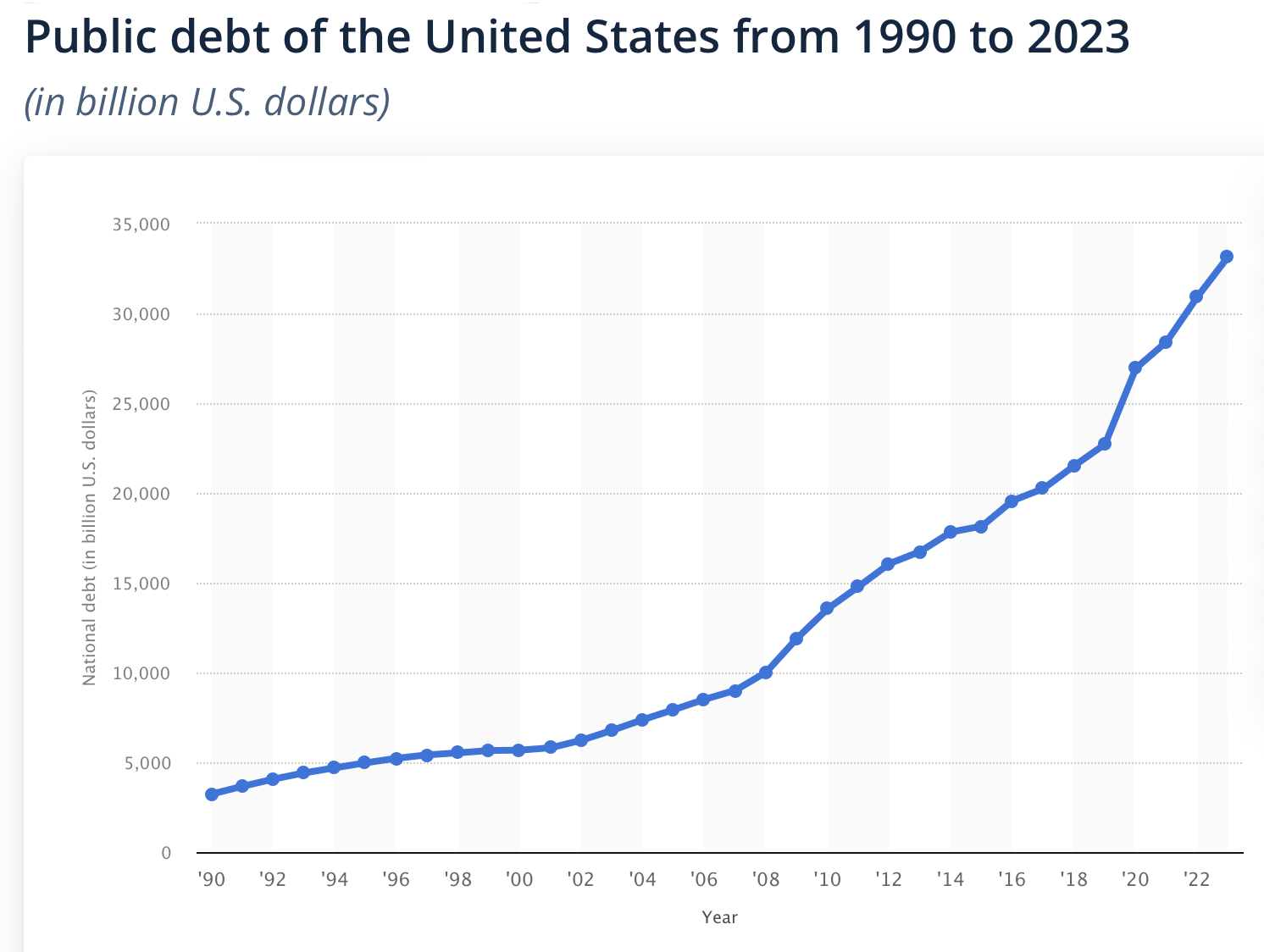

Not only have they remained central for insurers, but they have also grown in importance to governments looking to finance record deficits. Just how far the debt-led response to the pandemic has moved public debt beyond historic norms is especially apparent in the US where the Biden administration’s huge investment programme has been supported by debt (see chart).

Not only have they remained central for insurers, but they have also grown in importance to governments looking to finance record deficits. Just how far the debt-led response to the pandemic has moved public debt beyond historic norms is especially apparent in the US where the Biden administration’s huge investment programme has been supported by debt (see chart).

Alongside the rise in inflation and interest-rate response this returned fixed income to favour, says investment firm Invesco:

“Over the last couple of years, bonds have been anything but boring. The low-income environment that the world lived through in the aftermath of the global financial crisis has been completely turned on its head.

“First a pandemic, then supply chain disruption, and then the outbreak of war in Europe. Each of these factors contributed to the highest level of inflation experienced in a generation, and a cycle of aggressive interest rate hikes from almost all major central banks.

“Against this backdrop, fixed income has defied its staid reputation by experiencing almost unprecedented volatility, and now presents rare opportunities. Put simply, the ‘income’ in ‘fixed income’ is back.

“As we head into 2025, we believe the case for the asset class is the strongest it has been for years, with the potential peak in interest rates offering the opportunity to lock in a higher level of income for the years to come.”

James Ong, Invesco’s senior portfolio manager, Fixed Income for Invesco put some detail on this scenario:

“Our outlook for interest rates suggests that US Government bonds are expected to yield returns comparable to T-bills [Treasury Inflation-Protection Securities}, albeit with higher volatility. This indicates that while the potential for gains exists, we should be prepared for more significant fluctuations in bond prices. A steeper yield curve presents the most promising opportunity over the long term.”

Of course, this is a far from simple picture, and the opportunities are not just limited to government securities as Ali Zane, a California-based credit and debt expert has noted:

“A significant shift in fiscal policies under the new administration could have a dual impact. Expansive fiscal spending, such as large infrastructure projects, could inject growth into specific sectors but will likely drive inflationary pressures. Institutional investors must be cautious about long-duration bonds, which will lose value in a rising rate environment. Focusing on shorter-duration debt or inflation-protected securities like TIPS might be prudent to hedge against these risks.”

So much depends on the trajectory of interest rates which, in turn, largely depend on where US inflation heads – steady is possible, down is unlikely but upwards is the fear.

The promised large infrastructure projects could create inflationary pressures. If the tax cuts favoured by Trump boost consumer spending, they too could add to the upward pressures. Then there are the tariffs, perhaps the biggest unknown. If they unleash a global trade war then prices of goods imported into the US could start to rise sharply.

Offsetting these potentially inflationary pressures will be the Elon Musk-led deregulation which may reduce costs for many key sectors, such as energy – fossil fuel – production, technology – especially as the US races to lead the world in the development of artificial intelligence – and the financial service sector. This could make some sectors attractive either as direct equity investments or via higher grade corporate bonds.

If interest rate rise, “US fixed-income accounts could see negative returns in the short term, says Zane. “However, for pension funds or insurance companies, this presents a chance to adjust portfolios by adding short-term, higher-yielding instruments that won’t be as vulnerable to price depreciation. Focus on corporate bonds with solid credit ratings or municipal bonds could provide steady income while avoiding interest rate volatility.”

The answer to the crucial uncertainty surrounding inflation and interest rates is vigilance, says Ong:

“A key risk we need to manage in this environment is the potential inflationary impact of an expansionary fiscal policy in an already tight labour market. Increased government spending could drive inflation higher which could drive volatility in interest rates. By staying vigilant and responsive to these developments, we can better navigate the complexities of the interest rate environment and make informed decisions to optimize our portfolios.”