Insurers are looking to hold their nerve when it comes to asset allocation despite growing concerns about the threat of economic turbulence and geopolitical instability.

This “steady as she goes” message on asset allocation comes through very clearly in US asset manager Nuveen's fifth annual EQuilibrium global institutional investor survey, writes Contributing Editor David Worsfold.

The survey is large with 235 insurance companies globally (along with 565 other institutional investors) contributing their views on the macro environment and portfolio construction. The insurance companies that responded are estimated to be managing US$6tr in assets.

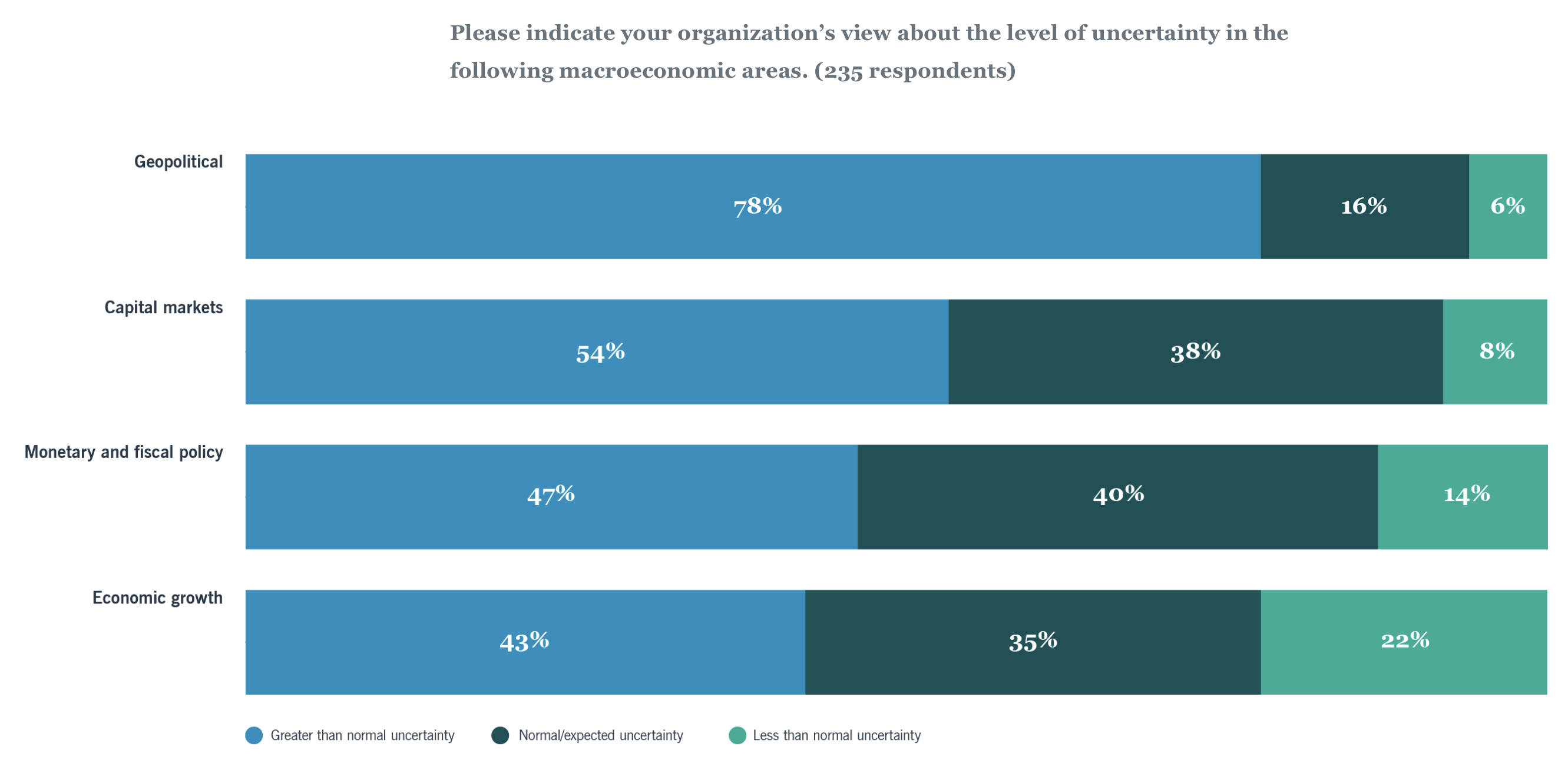

The level of uncertainty around key macro-economic areas remains at heightened levels, especially with 78% of those surveyed citing geopolitical uncertainty as above normal levels (see chart). This reflects the findings of other surveys, including the Bank of England’s most recent Systemic Risk Survey.

In a recent speech on geopolitics and financial stability, Carolyn A Wilkins, an external member of the Bank’s Financial Policy Committee (pictured), summed up how dramatically the world has changed for major financial institutions:

“Today, the belief that has been severely shaken is that global economic integration would support long-lasting geopolitical stability. We’re seeing increased trade restrictions, including some in the name of national security, creating the risk of fragmentation of global trade. At the same time, the uniting power of some post-World War II international institutions is under pressure.

“Today, the belief that has been severely shaken is that global economic integration would support long-lasting geopolitical stability. We’re seeing increased trade restrictions, including some in the name of national security, creating the risk of fragmentation of global trade. At the same time, the uniting power of some post-World War II international institutions is under pressure.

“It’s not surprising that a recent Bank of England survey found that geopolitical risk and cyber-attacks are the most frequently cited risks among financial institutions (FIs). Many boards of directors are factoring into their calculations a range of geopolitical risks to their institutions, including the effects of increased regulatory and trade restrictions, and more-extreme scenarios like cyber warfare or actual physical warfare.”

Just a few years ago it would have been almost unthinkable to be setting out such a scenario.

What might be surprising is the response of insurers’ chief investment officers to this dramatic change in the wider context in which they operate and make decisions.

The EQuilibrium survey found that while insurance companies will continue to make portfolios adjustments, they will be on a smaller scale compared with the repositioning over the past few years as the world emerged from the era of rock-bottom interest rates:

“It seems insurers have settled into a new equilibrium. This follows the significant portfolio changes over the last two years as we moved into the new more normalised interest rate environment”, says Equilibrium.

“Only 17% said they were making foundational changes to strategic asset allocations compared with one in three in 2023, and 27% were making significant tactical allocation changes compared with 44% in 2023.”

One explanation for this stability in the face of uncertainty is the feeling that CIOs are looking away from the geopolitical hazards they can do little about and which are increasingly unpredictable and focussing on those factors that lend themselves to more rigorous approach and where modelling tools can be more effective and reliable.

While overall 59% say uncertainty levels are greater than normal it is the geopolitical element that pulls that up. The overall uncertainty level in 2024 was actually down from 69% a year earlier.

This decline in the headline figure was driven largely by more conventional macroeconomic factors. 43% stated economic growth uncertainty was greater than normal (compared with 63% previously). Capital markets were also a factor, with 54% stating capital market uncertainty is greater than normal (compared with 61% a year ago). The caveat here must be that the survey responses were largely gathered before the full extent of the new US administration’s tariffs were known.

Looking at the detailed responses, EQuilibrium highlights some of the shifts in expectations around allocations to private assets.

It found that 95% of insurers plan to maintain or increase private market allocations over the next five years. And over the next two years, private fixed income is the most popular route for doing this.

“While the well-established private credit, infrastructure and real estate debt remain popular, we’re also seeing net new money going into niche and specialised areas such as net asset value (NAV) lending (which is a form of fund financing) and junior capital in the middle market lending space. In many cases, these assets are viewed as a complement to senior loan allocations in portfolios, offering diversification, spread and idiosyncratic risk exposure.”

Behind these headline figures, there are some significant regional differences. however:

“US insurers appear to be more interested in esoteric asset-backed securities and collateralised loan obligations than their peers in other countries. In Europe, consumer finance, credit tenant loans and private infrastructure find favour among UK insurers, while German insurers are exploring private infrastructure debt, including energy infrastructure credit, and junior and mezzanine debt. In Asia Pacific, digital infrastructure assets, private credit within the region and royalty streams are garnering interest.”