European regulators have urged financial institutions to increase vigilance and maintain adequate provisions in today’s tense and unpredictable geopolitical environment and growing fragmentation of the global economy.

Europe’s three key regulators – the European Insurance and Occupational Pensions Authority, European Securities and Markets Authority and the European Banking Authority – have collaborated on a new report with stark warnings about how tensions in global trade and the global security architecture have deepened geopolitical uncertainties. The regulators say that the European financial system has so far demonstrated resilience but warn of significant risks and growing uncertainty, writes Contributing Editor David Worsfold.

Alongside the unpredictable trade wars and the continued escalation of security concerns on Europe’s eastern borders, the regulators also stress the need for a clear focus on cyber risks and the potential for contagion from crypto assets.

The underlying theme of the report is that uncertainty haunts the markets and will not go away anytime soon: “Sudden structural changes in global trade and security have led to a deterioration in the economic outlook in the first half of 2025. Despite the initial moderate impact of the US-EU preliminary trade agreement, risks to financial stability and the risk of further corrections remain.”

It paints a stark picture of the impact of that uncertainty.

In April, the International Monetary Fund lowered its global growth estimates to 2.8% for 2025 and 3% for 2026, both down from the 3.3% January estimates. US growth in 2025 was lowered to 1.8%, 0.9 ppt down, and EA growth was lowered from 1% to 0.8%. In May, the European Commission revised its growth forecasts down for the EU, to 1.1% for 2025, down 0.4ppt, and to 1.5% for 2026, down 0.3ppt. “The reduction in growth was associated mostly with the ongoing uncertainty and to a lesser extent with the economic impact of tariffs. More severe tariffs or further retaliation would worsen the outlook”, says the report.

Into this already volatile mix is the uncertainty over the direction of interest rates, especially with the fractious relationship between the White House and the Federal Reserve showing every sign of getting more fraught.

The regulators do offer some reassurance in the report, however:

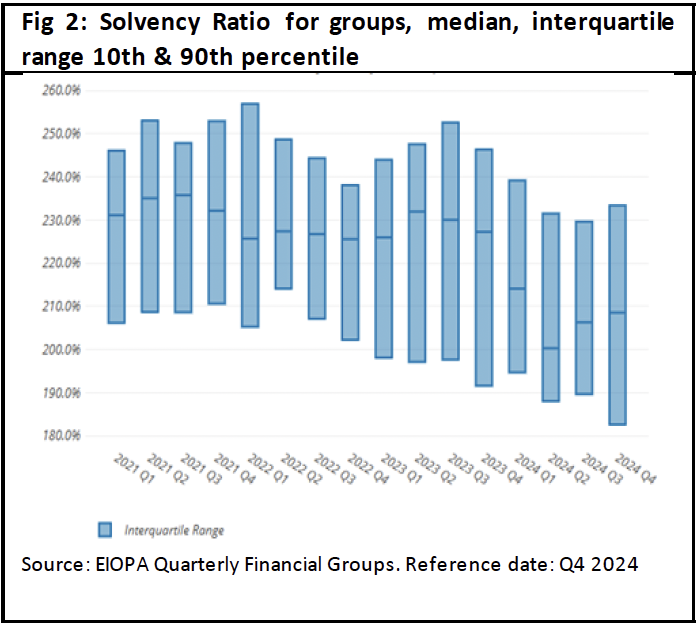

“The European financial system has demonstrated its resilience. Banks continue to generate solid profits, insurers hold strong solvency positions, and pension funds remain well-funded. Market infrastructures and money market funds have also proven robust in the face of volatility.”

It concludes that the insurance sector is weathering the storms:

“After a period of stagnation, life premiums are growing again, and technical cash flows improved from previous year. With interest rates stabilising, lapse rates may have peaked. The unit-linked business has also recovered, reversing its decline since 2022. Profitability has improved, driven by strong investment returns. The industry, due to its adequate capitalisation, is well equipped to withstand market turmoil that materialised in the second quarter of 2025.”

“After a period of stagnation, life premiums are growing again, and technical cash flows improved from previous year. With interest rates stabilising, lapse rates may have peaked. The unit-linked business has also recovered, reversing its decline since 2022. Profitability has improved, driven by strong investment returns. The industry, due to its adequate capitalisation, is well equipped to withstand market turmoil that materialised in the second quarter of 2025.”

It is less sanguine about the occupational pensions sector, which faces some significant structural challenges alongside the need to manage the geopolitical turmoil:

“The ongoing transition from DB to DC schemes represents a major operational challenge for the sector and might reshape investment strategies and exposure to equity market volatility, and longevity risks, particularly affecting women. A robust three-pillar pension system can help mitigate these risks, reduce pension gaps, and support the Savings and Investment Union by increasing investment through pension savings. The recent market turmoil in April also warrants close monitoring of IORP (Institution for occupational retirement provision) funding ratios and liquidity positions.”

Strong scenario planning, drilling down into how the risks could impact portfolios is essential, say the regulators:

“Tariffs and currency shifts are impacting commodities and foreign exchange markets and create new channels through which risks can spread to financial institutions. Strong interlinkages with US financial markets deepen undertakings’ sensitivity to these risks.”

The report analyses the impact of the volatility on a wide range of assets and currency relationships, including data on the trends in aggregate solvency margins across European insurance groups.