Predictions of how a whole year in the financial markets will pan out seem to be increasingly challenging. It is now an accepted truism that we live in uncertain times and that has shattered some previously accepted – perhaps too cosy – assumptions. Although it may be harder, looking forward is more important than ever for the stewards of the billions in assets managed by insurers and pension funds.

In the first of two previews of what the rest of 2026 might hold, the Insurance Investment Exchange offers some contrasting views of what we could expect in terms of asset classes that might thrive and others that might dive.

Our contributors

Sian Fisher (SF) • Currently a non-executive director of major London Market insurance firms. Chair of the Worshipful Company of Insurers Insurance Non-Executive Directors Forum. Past CEO of the Chartered Insurance Institute. Senior roles at Hiscox and Arthur J Gallagher.

Erik Vynckier (EV) • Former chair of the investment committee at Foresters Friendly Society and investment consultant

David Worsfold (DW) • Contributing Editor, Insurance Investment Exchange

Which asset classes and markets will be the winners in insurer portfolios in 2026?

SF • General insurance almost entirely uses high quality fixed interest investments which don’t need to take super long-term bets. Split fairly equally between Governments and Corporates. Media hysteria does not translate into economic realities, currently GDP and inflation are relatively stable. As Government default is so unlikely why not take greater returns from France and Italy? Is Japan a good bet in 2026 – poised for the “Takaichi trade”.

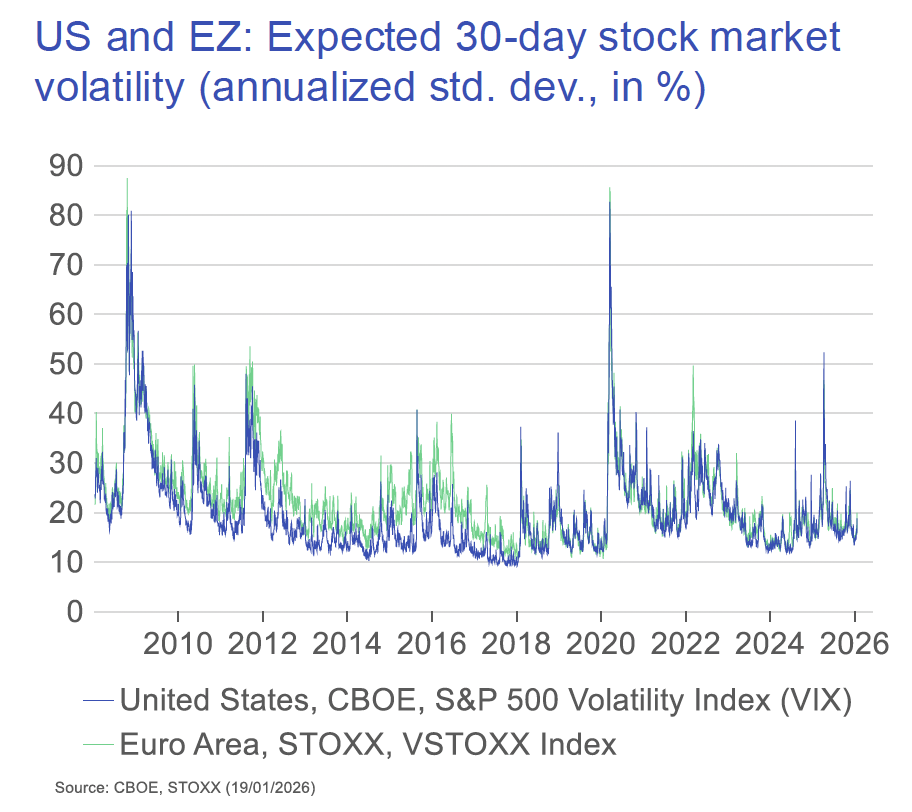

DW • So often in the last few years, predictions about the performance of various assets have been caveated with warnings about volatility. There are signs we have coming out of the worst of the recent period of extreme volatility (see graph 1). Does this mean we can be any more confident? Perhaps in a few areas.

Infrastructure equity and debt will offer growth, especially energy transition, digital infrastructure and regulated utilities, with some areas enjoying indirect – even direct – government support as the global battle to become centres for AI intensify.

Private credit and asset-based finance should remain core winners, offering yield, covenant control and capital efficiency under the various evolving solvency regimes.

High quality private equity plays will also be available, although the catch will be to ensure that viable exit routes are available.

EV • In one word, I see no obvious winner. What I get presented is more the marketing logic of asset management firms (who have to be enthusiastic about some product they are pitching) than genuinely good assets.

There are some good selective strategies in: venture growth debt (senior in the stack to venture capital and high yielding), commodities trade finance and invoicing (true invoices, not the sort of inventory backed corporate debt that went bust in 2025 but independent, uncorrelated third-party counterparty risk) and securitisations and asset-backed finance (which I prefer at equal rating and higher spread to the very thin spreads in corporate investment grade and high yield credit).

Collateralised Loan Obligations (CLOs) and hard currency emerging market debt still earn higher credit spreads than investment grade debt, although spreads have narrowed there to a point where I am indifferent to the asset class, although I prefer them to regular developed market credit risk.

Short credit and money market commercial paper are a reasonable replacement for cash and liquidities and I still buy those. Although spreads are thin, the credit horizon is very short too.

The catastrophe bond market is still attractive although spreads have reduced from November 2023. This is obviously for insurers who do not already have those risks in their underwriting practice. Alternatively, such insurers could consider issuing catastrophe bonds.

Private debt (mid-market acquisition financing) and infrastructure debt are still attracting commitments but struggle to deploy. A quality strategy seems the best bet at the moment – working with asset managers with a track record.

Which asset classes could fall out of favour and why?

SF • Logically the US is still a good bet with US productivity able to counter the effects of sanctions and inflation. But too much political interference with the Fed could force unusual diversification into non-US markets.

The massive investments in AI backed by bonds could be a problem for the tech stocks if there is any kind of bubble deflation, but if US rate cuts go through in 26, profits will increase, as a counterbalance.

EV • The current problem with private equity and with venture capital is that there are scarcely any exits. The exits that do happen are some limited industry purchases (this mostly in the mid-market and with sector-specific specialist private equity managers) and transfers (more so than exits) to the controversial continuation funds. There are a host of governance and incentive issues around the continuation funds and secondary funds. The questions are about valuation and what the continuation funds are to do with these apparently stuck dead-in-the-water objects. The implicit assumption seems to be that secondary funds would be better at value creation than the original private equity firms. I cannot spot a rational basis to that belief.

The deflation of the bubble of illiquid private and venture equity positions may take a very long time as no one wants to admit reality and the commission flows and asset management fees are enabling people to deny reality for a very long time, and they have a substantial interest in sticking their head in the sand, so that will determine their behaviour.

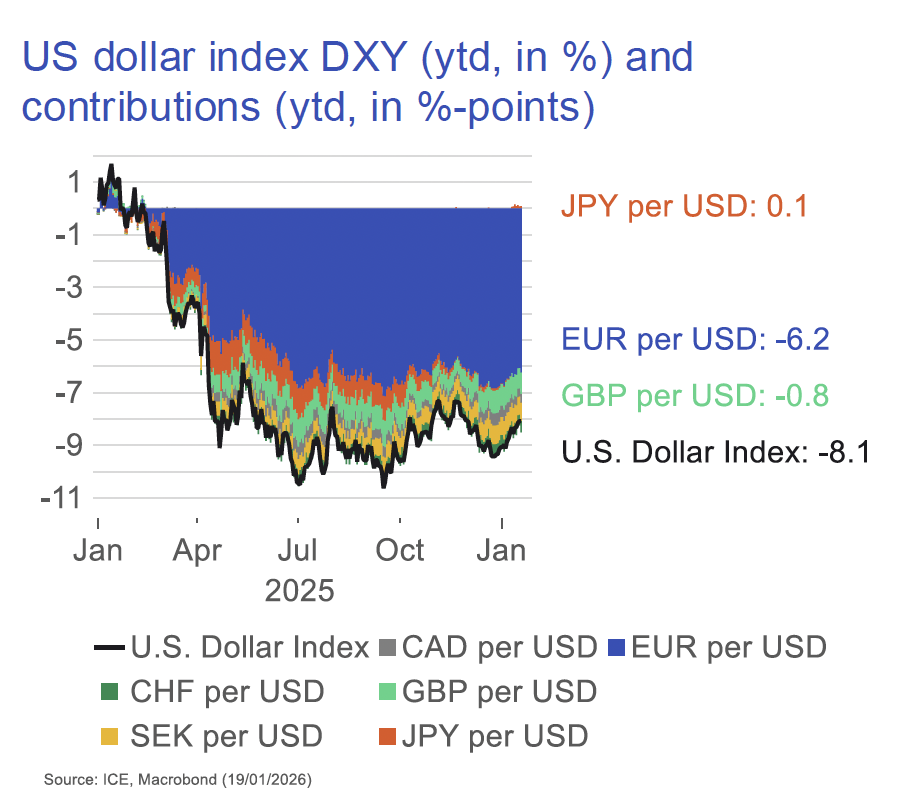

DW • This is clouded by the wider geo-political risks with some counter-intuitive trends emerging, most obviously the weakness of the Dollar, which has traditionally strengthened as a safe haven as uncertainty rises (see graph 2). As 2026 opens this safe haven status seems reserved for gold, hardly an asset for the world’s insurers.

Other worrying areas are overvalued real estate, particularly offices out of favour in the new world of hybrid working. Location is everything now. Insurers tempted to add too high a proportion of illiquid private assets in the search for yield over the last decade could face some tough questions as boards focus on liquidity stress testing. They will have few options but to mark down their value.

- Next week we will look at the impact of digital transformation, both in terms of the growth of digital assets and the arrival of artificial intelligence in the world of asset allocation and portfolio management.