The first Insurance Investment Exchange seminar of 2019, held at Salters’ Hall in the City of London, dipped its toes into the chilly currents of economic uncertainty swirling around the global economy. Volatility and uncertainty might be all around them but the chief investment officers in the audience were certain about one thing.

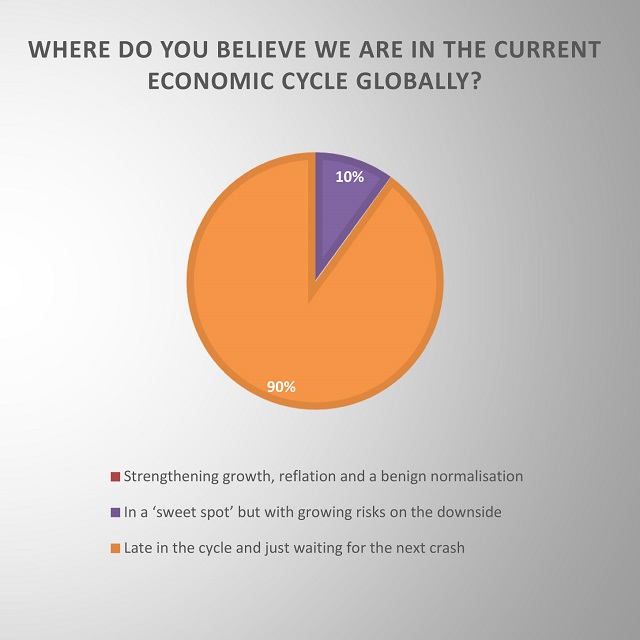

Asked during the interactive voting – a popular feature of Insurance Investment Exchange seminars – where they believed we might be in the current economic cycle, 90% answer ‘Late in the cycle and just waiting for the next crash’. A handful of diehard optimists said they felt we were ‘In a sweet spot but with growing risks on the downside’, although even this proportion was slightly down on the November 2018 seminar voting which is when sentiment first took a major nose dive.

A year ago, the pessimists – or realists if you prefer – numbered just a quarter of the audience.

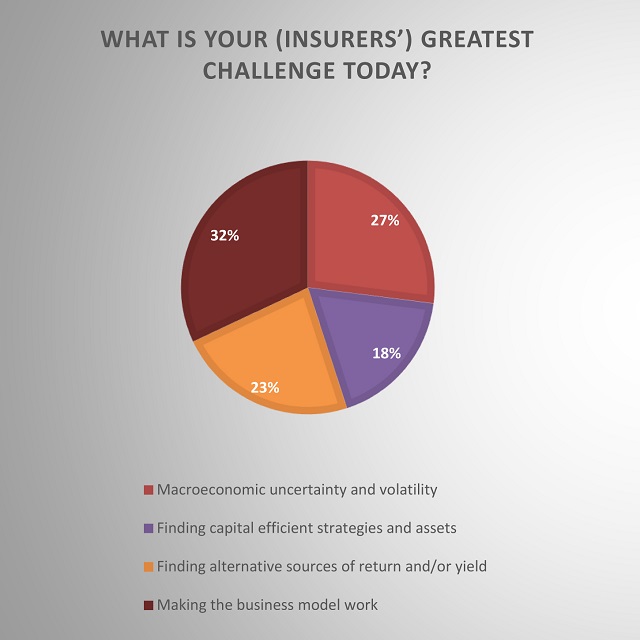

Despite this almost universal belief that we are in a very vulnerable place in the economic cycle, it is not the overwhelming concern of CIOs. The responses to the question ‘What is your (insurers’) greatest challenge today?’ suggests the typical CIO’s in-tray has plenty else demanding their attention.

While just over a quarter (27%) view the macroeconomic uncertainty as the biggest challenge, others are prioritising other issues, although the nagging concerns that the business model itself is flawed will not go away. This has been the key concern of 30% to 40% of seminar attendees for over two years.

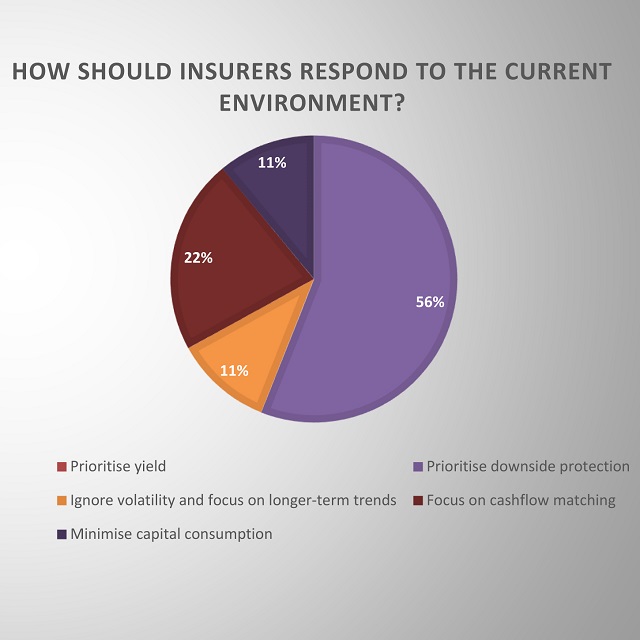

For the shorter term response to the current economic environment, sentiment moved little between November last year and now with over 50% saying their priority would be downside protection.

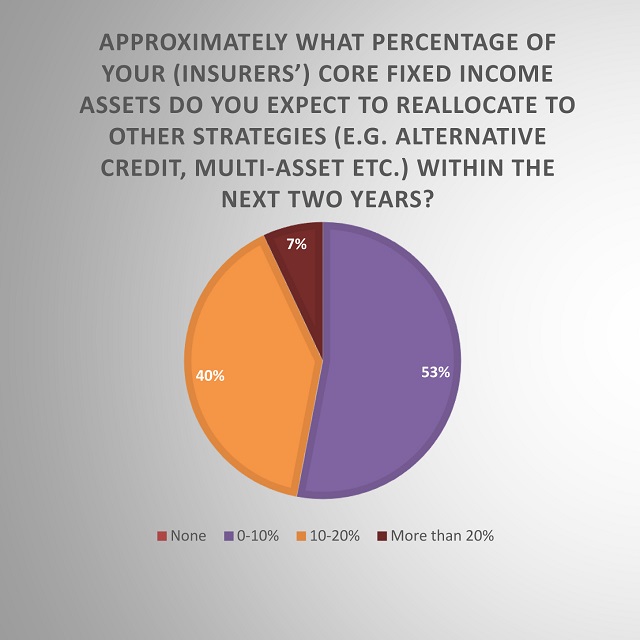

This poses the question about what downside protection might look like and something of a clue emerged in the responses to the longest question in the two interactive voting sessions: ‘Approximately what percentage of your (insurers’) core fixed income assets do you expect to reallocate to other strategies (eg alternative credit, multi-asset etc) within the next two years?’. While the majority are still hovering in the 0-10% range, there has been a steady drift of insurers into the 10% to 20% range over the last year. A year ago is was less than a fifth: now that proportion has doubled.