The Insurance Investment Exchanges’s first virtual event opened up the discussion about the challenges insurers face on the investment front in the wake of the Covid-19 pandemic.

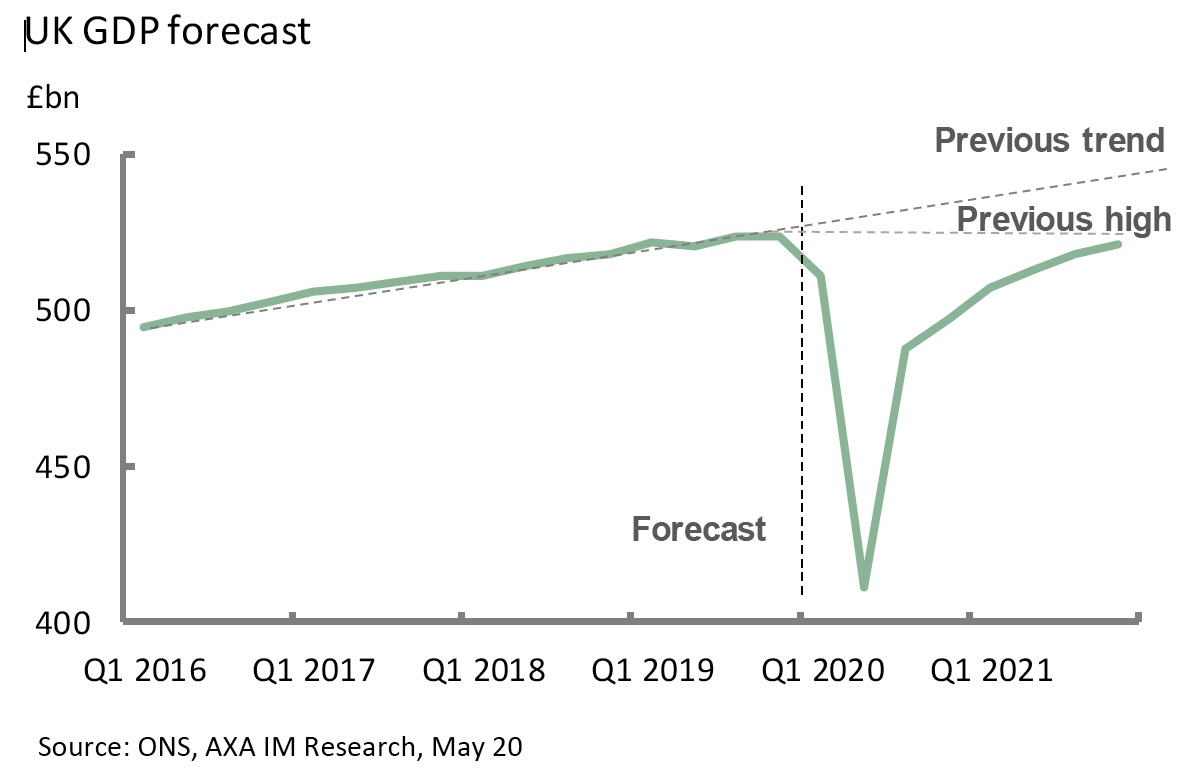

A wide-ranging presentation by David Page, Head of Macro Research at AXA Investment Managers, set out the macro-economic context of the changed world. He analysed the key trends, including the prospects for recovery forecasting that it would be the end of 2021 before the UK economy was back on track with previous growth trends.

In commenting on the part central banks are playing in supporting markets through the crisis he warned of the weakening impact of QE going forward because their room for manoeuvre is now getting very limited. He said the impact of the crisis and the government and central bank interventions on inflation is likely to be complex and diverse. The net impact is likely to disinflationary for the next two years at least, he predicted.

He also reminded the audience that another big disruptive event was looming: Brexit. Read the pre-event interview with David Page

In the panel discussion that followed David Thompson, UK Life CIO at Zurich Insurance, said finding assets with decent sustainable returns will become harder, warning that many may look superficially attractive but will offer weak returns in real terms

Con Keating from the Brighton Rock Group said he found the disconnect between what is happening in the real economy and in stock markets difficult to understand and feared that the recent strong recovery in share prices was not sustainable.

He also believed pensions face a double squeeze. With the very poor investment returns available it is inevitable that annuity rates will fall further with additional downward pressure coming from the review of the retail price and consumer price indices which will probably result in a lower rate of uprating.

The audience polls that are a popular feature of Insurance Investment Exchange events featured in the virtual format. 71% of the audience felt the key challenge for insurers would be balance sheet volatility with two-thirds saying this would be against the background of a prolonged economic recovery stretched out over several years.

•••••••••••••

The macro overview sets the scene for our next IIE e-Event on 16 and 17 June. We will debate and analyse the state of play for fixed income, future emerging dislocations and the outlook for insurers' portfolios as the pandemic dust clears. Topics include examining the outlook for private debt assets, real economy financing as an emerging theme for insurers, how STS and structured credit have held up after their debacle in the last crisis, and hints on the way back from Asia.

These topics will be covered by M&G Investments and Allianz Global Investors.

There will be opportunities to fire questions at the presenters and panellists and vote in the polls during the two 90 minute sessions conducted using Zoom.

Through a Mirror Darkly: Surveying the insurance landscape and portfolio post-pandemic. Where next?

Tuesday 16 June, 10am-11.30am

Wednesday 17 June, 10am-11.30am

This two part virtual event is complimentary for insurers, regulators and select independents. It is also eligible for CPD points and quarterly certificates will be issued to attendees to confirm their attendance.