Influential climate change campaigners are growing in ambition when it comes to demanding action from the finance sector. Initially they focussed on coal – pressing insurers to walk away from underwriting and investing in coal – but they have now added oil and gas to their targets.

News & Commentary

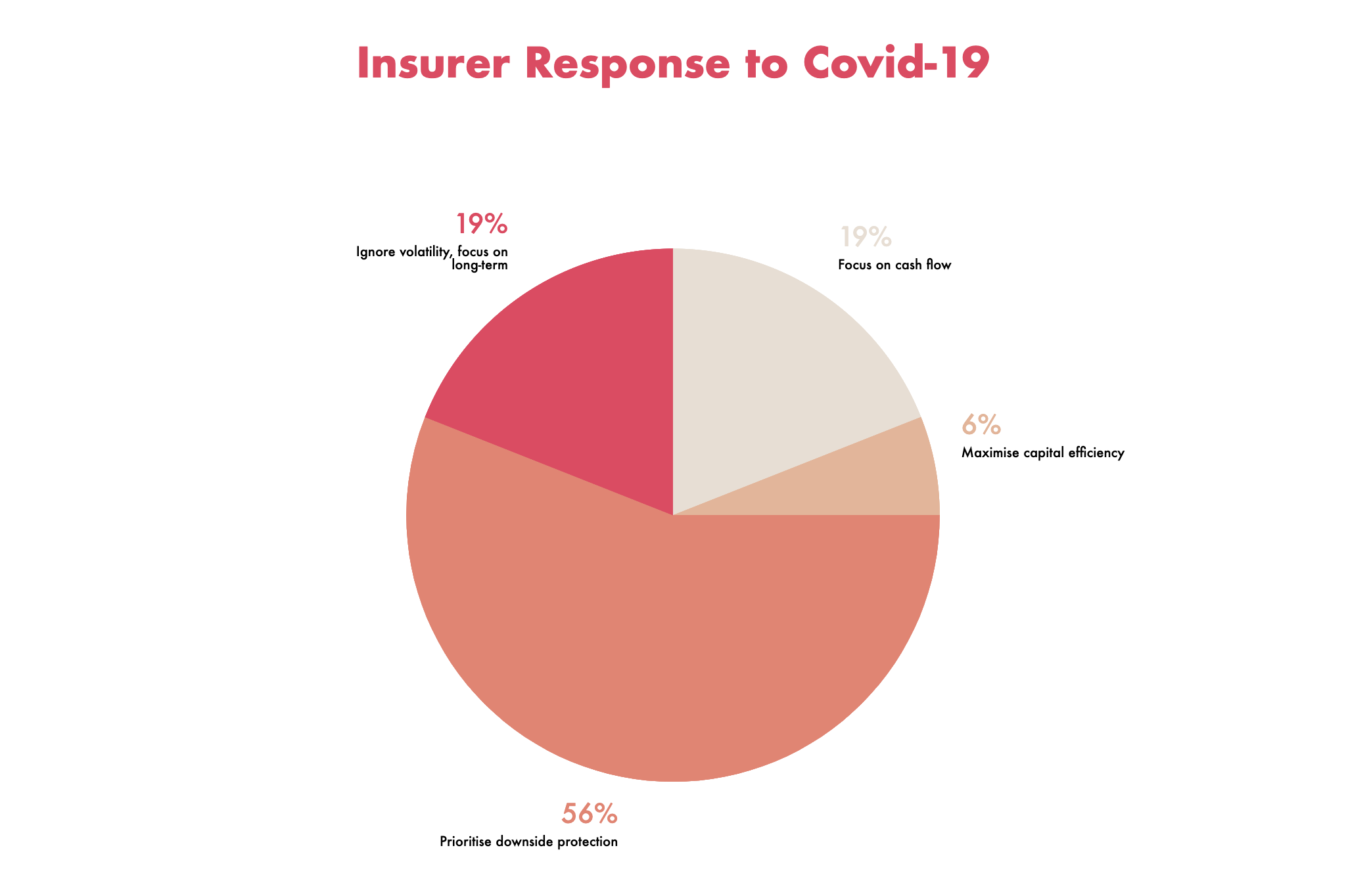

Insurers will be focussing hard on protecting investment portfolios against the potential downsides as the Covid-19 crisis continues to reverberate around the world.

The focus of this week’s Insurance Investment Exchange seminar - held over two mornings - was private credit. Will Nicoll, Chief Investment Officer, Private and Alternative Assets at M&G Investments, who joined one of the panels, expanded on his thoughts in an interview with the Insurance Investment Exchange.

The Insurance Investment Exchanges’s first virtual event opened up the discussion about the challenges insurers face on the investment front in the wake of the Covid-19 pandemic.

The Prudential Regulation Authority has said that changes to the Solvency II regime could be needed in response to the pandemic, Brexit and climate change.

Lockdown hasn’t quite ended, but little shoots of normality are appearing as countries begin to reopen. Our recent weekly updates contain helpful summaries of key data, trends and analysis to help insurance company investemnt bosses cut through the noise.